Attorney Services Tips for Credit Professionals

Struggling to manage A/R and past-due accounts? In this video, we’ll share key best practices to help you determine when it’s time to turn to us for expert support.

Infographic: Most Common UCC Filing Myths - Busted

Sometimes UCC filings get a bad rap because of common myths like "I'll always be behind the bank." So we've rounded up some of the top myths and our UCC experts have busted them!

NCS Credit's Year-End Collection Tips 2024

Hard to believe 2024 is nearly over! As you prepare your A/R for year-end, let's review a few collection tips to help you close 2024 and prepare for 2025.

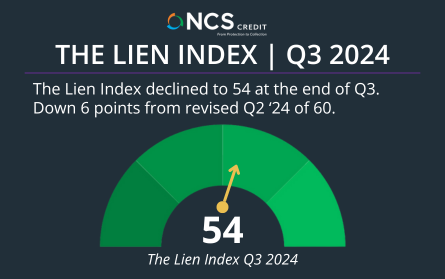

NCS Credit Lien Index Q3 2024

The Lien Index declined to 54 at the end of Q3, down 6 points from the revised Q2 Index of 60 and down 4 points over Q3 2023.

Credit Professionals 2024 Pre-Election Policy Uncertainties

Listen to Alec Papesch for a 2024 pre-election update tailored for credit professionals about policy uncertainties.

Unlock the Power of Mechanic's Liens

In this article, we’ll review what the mechanic’s lien process is and why it’s important to your credit management process. You too can unlock the power of mechanic's lien and get paid for the work you do.

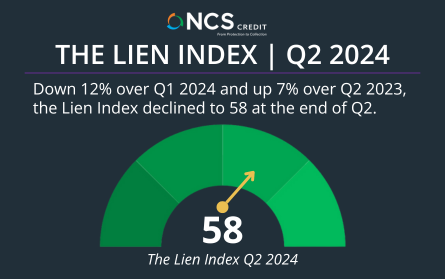

NCS Credit Lien Index Q2 2024

The Lien Index declined to 58 at the end of Q2, down 8 points from the revised Q1 Index of 66 and up 4 points over Q2 2023.

Primary Types of Lien Waivers

This infographic reviews the fundamentals of conditional, unconditional, partial, and final lien waivers. Ready to learn more about the primary types of lien waivers and which waiver could provide you with the best leverage?

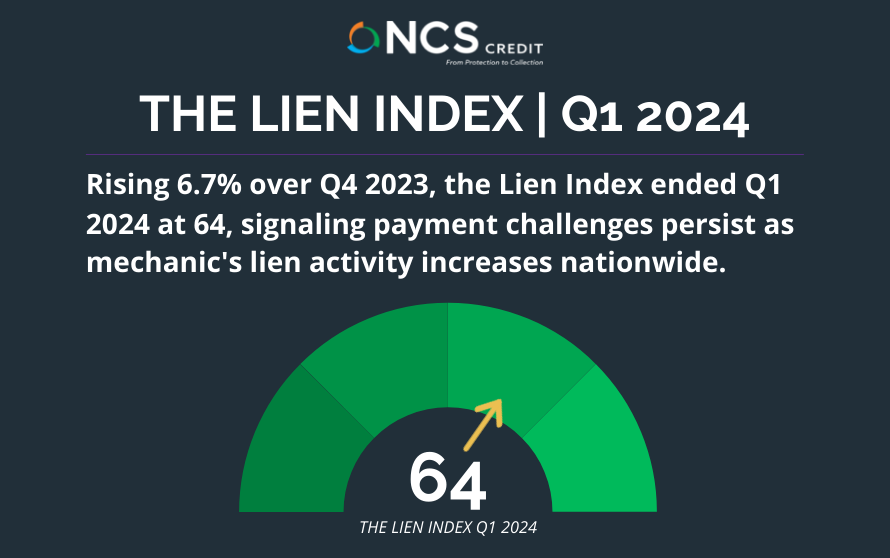

NCS Credit Lien Index Q1 2024

Rising 6.7% over Q4 2023, the Lien Index ended Q1 2024 at 64, signaling payment challenges persist as mechanic's lien activity increases nationwide.