Which States Require Lien Waivers to be Notarized?

We are often asked “Does this lien waiver have to be notarized?” and the answer is “Yes, in Georgia, Mississippi, and Wyoming.” Let’s review these three states and their lien waiver requirements.

Lien Waivers in General

Every lien waiver should clearly identify the property name & project location, the debtor’s name (your customer), the invoice or purchase order number, the payment amount, and the disputed claim amount. If the lien waiver is for partial payment, you should also include the payment period or a through date.

There are four primary types of lien waivers:

- Partial Conditional: A signed document agreeing to waive rights to a claim for a dollar amount or through a specified date, conditioned upon receipt and clearance of the partial payment.

- Partial Unconditional: A signed document agreeing to waive rights to a claim for a dollar amount or through a specified date. The waiver is not conditioned upon clearance of a payment. If the check is not received, or does not clear, the contractor/subcontractor/supplier will have waived their rights to that partial payment.

- Final Conditional: A signed document agreeing to waive rights to a claim, conditioned upon receipt and clearance of a final payment. If the contractor/subcontractor/supplier does not get the final payment, or the payment does not clear, the waiver does not waive their rights.

- Final Unconditional: A signed document agreeing to waive all rights to a claim. The waiver is not conditioned upon clearance of a final payment. The contractor’s/subcontractor’s/supplier’s rights will be waived whether payment is received or cleared.

Georgia Lien Waivers

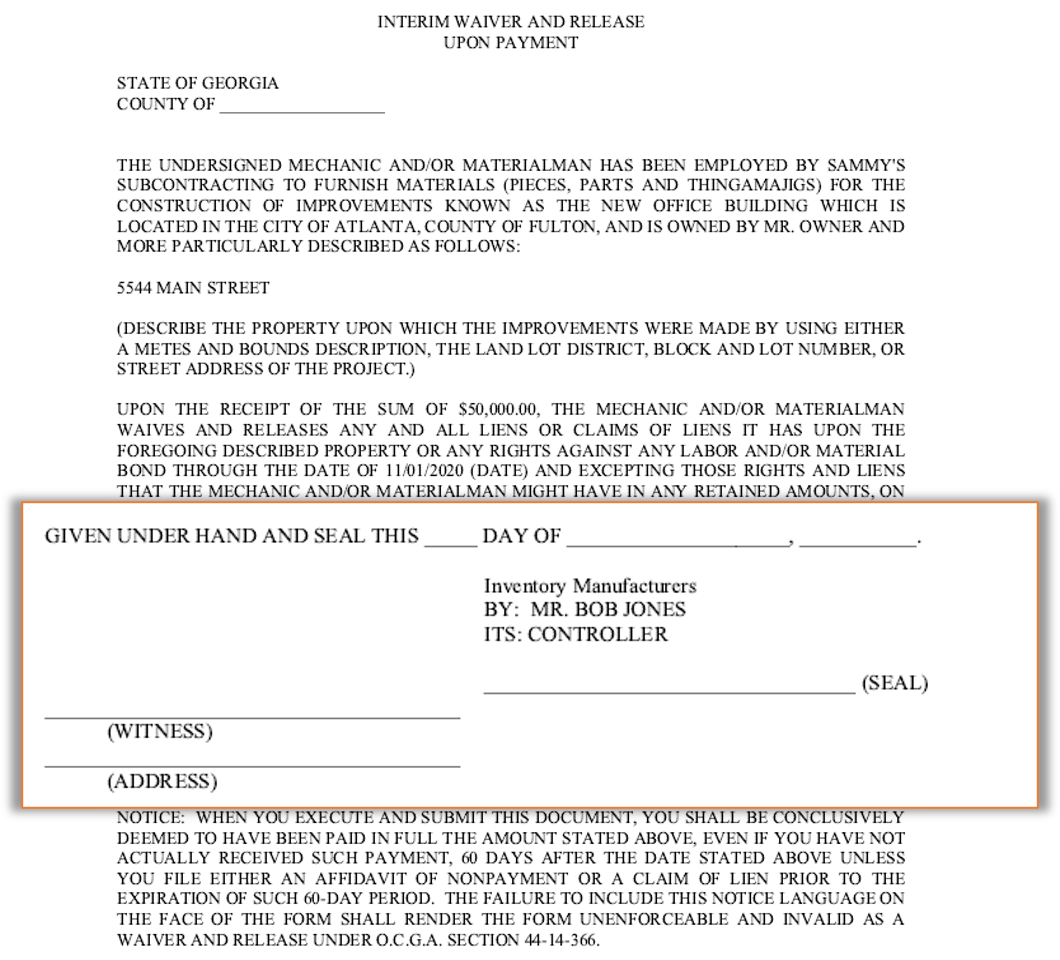

In Georgia, there are two primary lien waivers: Interim Waiver and Release Upon Payment and Waiver and Release Upon Final Payment. Soon, in January 2021, Georgia lien waivers will be changing (you can learn more about that here), but as of this writing, be sure your lien waiver format is in compliance with O.C.G.A. § 44-14-366. Here’s an example of an Interim Waiver and Release Upon Payment.

Technically, Georgia lien waivers require a witness and seal, which means a corporate seal could be used. In the absence of a corporate seal, notarize them.

Note the wording in the last paragraph of the waiver! If a waiver is signed and payment is not received, you may reinstate your rights by recording an Affidavit of Nonpayment or a Claim of Lien within the time frame specified. The requirements for the Affidavit of Nonpayment will also be changing as of January 1, 2021.

Mississippi Lien Waivers

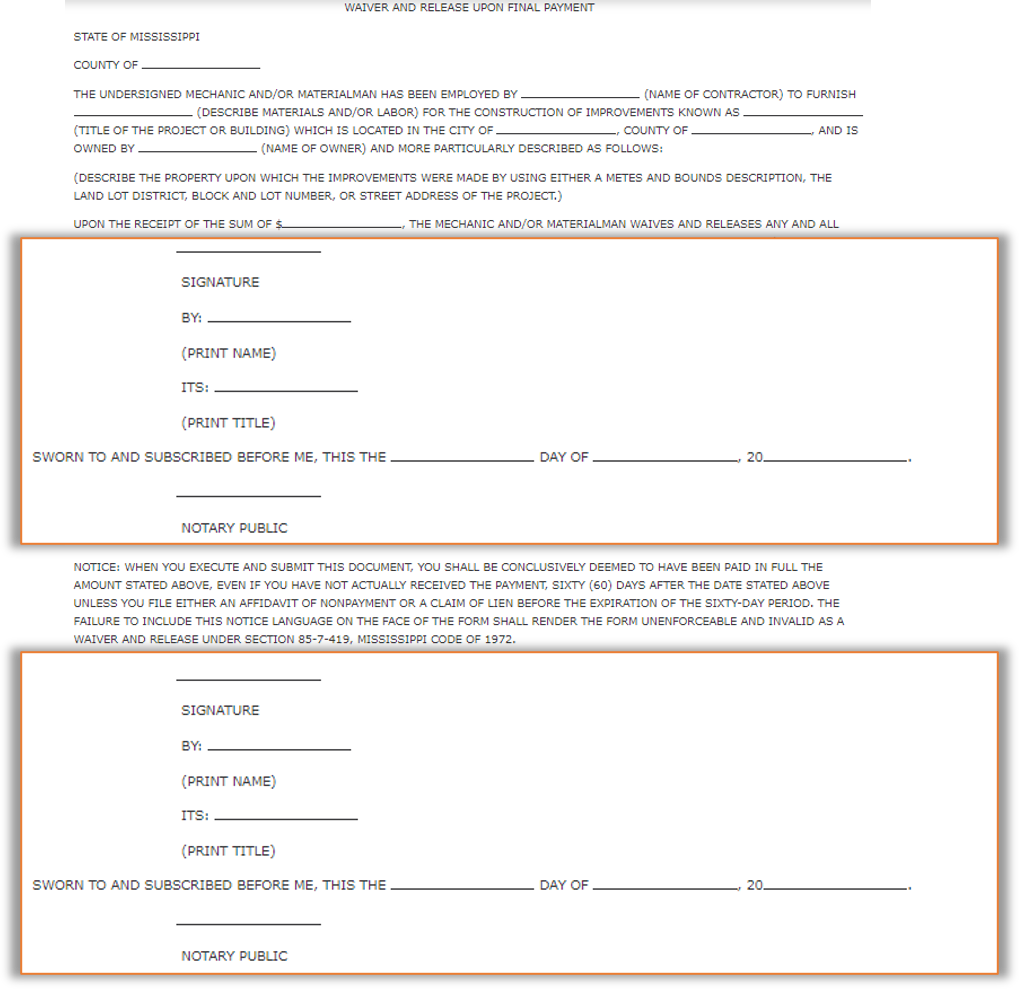

Like Georgia, Mississippi (§85-7-419) also has two primary lien waivers: Interim Waiver and Release Upon Payment and Waiver and Release Upon Final Payment. The interesting thing about Mississippi lien waivers is the final waiver needs to be notarized twice! Here’s an example of the final lien waiver, note the two notary sections:

Also like Georgia, Mississippi allows for the recording of an Affidavit of Nonpayment to reinstate your rights when a waiver is given but payment is not received.

Wyoming Lien Waivers

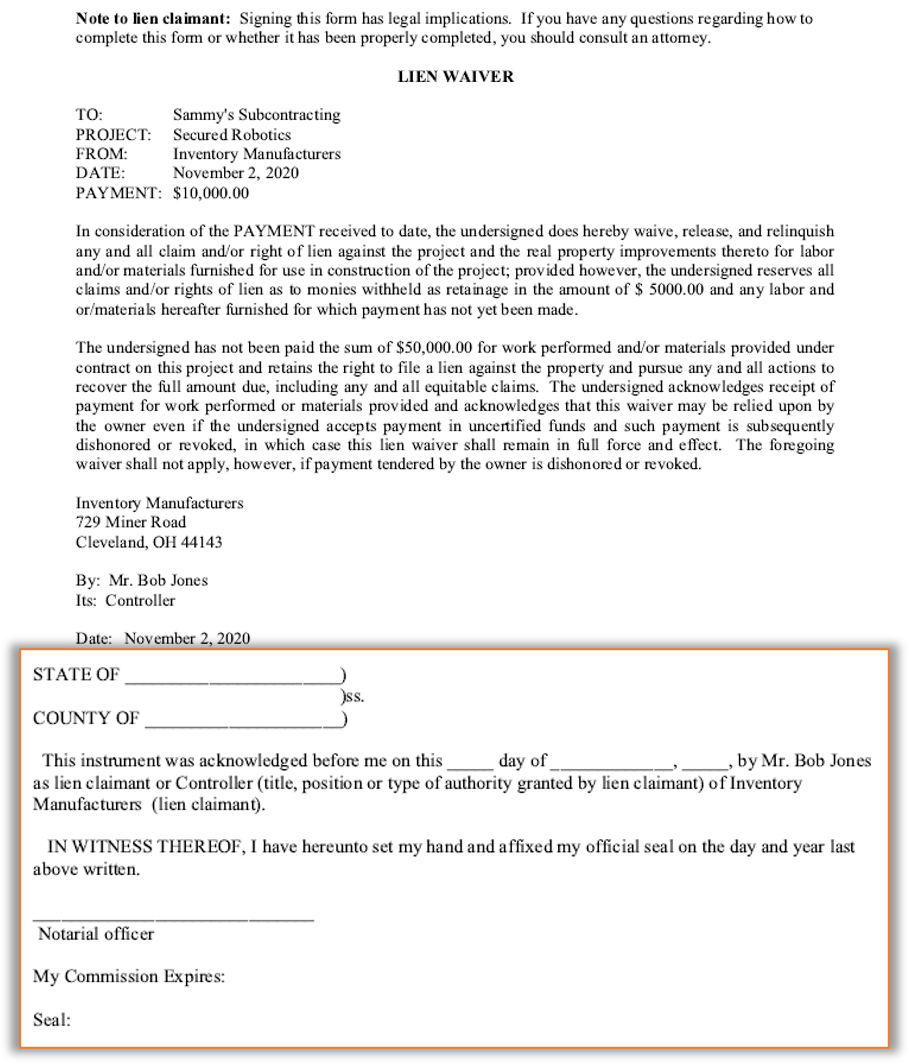

Rounding out our list is Wyoming (Wyo. Stat. § 29-10-101). Unlike Georgia, Mississippi, and Texas, Wyoming’s lien waivers follow one general format. Though, within the document it clearly identifies whether there are unpaid funds. It also includes a note that if you have questions about the waiver, consult an attorney before executing the document.

Ask Before You Sign

Before you sign a lien waiver, or any document for that matter, take time to carefully review. If you don’t understand the language or have concerns about what you may be waiving, seek a legal opinion. You don’t want to lose mechanic’s lien rights!

*Updated as of 01/01/2022. Original post from 12/2020 – prior to Texas lien waiver changes.