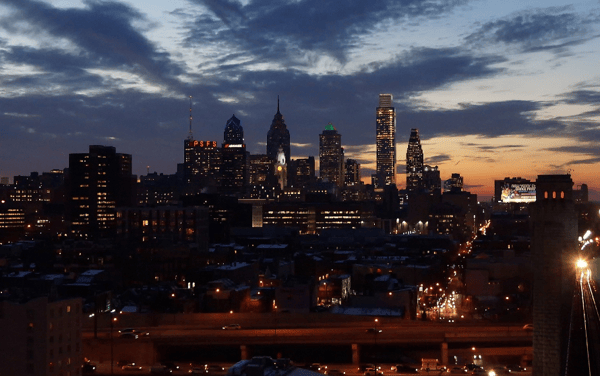

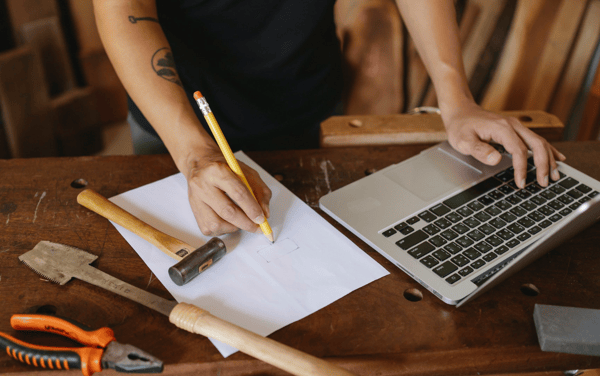

Extending Credit? UCC Filings Reduce Risk and Stress

UCC Filings Secure Your Equipment, Inventory and Receivables

![]()

Our holistic and cost-effective UCC filing programs will reduce your DSO, improve your cash flow and afford you the right to repossess your inventory or equipment. UCC filings can even increase your sales! With security in place, you can sell to previously unobtainable marginal accounts and increase your customer’s credit lines.

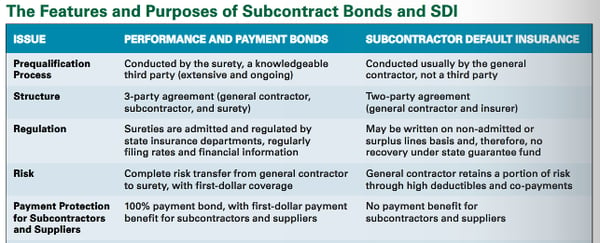

What is a UCC filing?

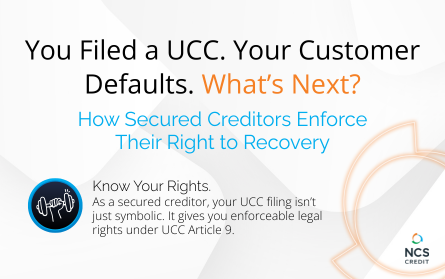

A UCC filing is a powerful way to protect your right to payment as a secured creditor. Filing a UCC-1 creates a public claim on a debtor’s assets—putting you at the front of the payment line in case of non-payment or bankruptcy.

Backed by Article 9 of the Uniform Commercial Code, UCC filings give trade creditors the legal standing to get paid for the work they do and the goods they deliver.

A UCC filing is not just a legal formality—it's a smart business move.

By securing your receivables, you reduce risk, improve cash flow confidence, and strengthen your credit decisions.

Protect Your Right to Get Paid

Protect Your Right to Get Paid

A UCC-1 filing puts you first in line to get paid by creating a legal claim on a debtor’s assets.

Backed by the UCC

Article 9 of the Uniform Commercial Code supports your right to secure interest in a customer’s property.

Reduce Risk. Gain Peace of Mind.

Reduce Risk. Gain Peace of Mind.

Protect your receivables, reduce bad debt, and move forward with more confidence.

More about the services we can help you with to make your life easier

We offer a wide range of services to help the credit professional get paid – FAST.

-

This is the accordion title

Lorem ipsum dolor amet aesthetic photo booth activated charcoal occupy iPhone schlitz squid. Everyday carry 3 wolf moon raw denim semiotics pok pok tattooed readymade bushwick. Humblebrag skateboard green juice mixtape polaroid ethical, messenger bag pitchfork sriracha hammock. Fam twee 3 wolf moon, authentic woke stumptown bespoke.

Section Headline

Why File a UCC-1?

Protection. Yes, in an ideal business relationship, bills are paid in full and on time – every time. But in a credit-based economy, there is little chance for ideals. File UCCs to protect A/R, inventory and equipment, reduce write-offs and create sales opportunities.

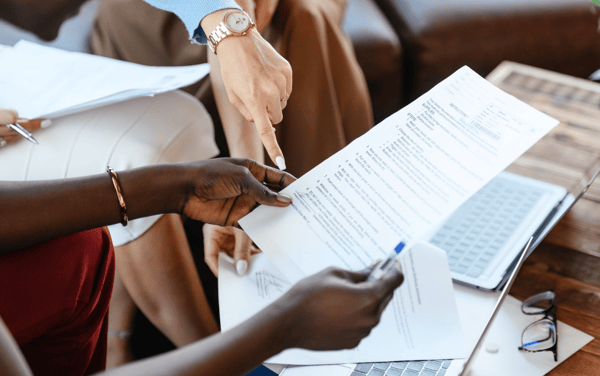

Who Should File UCC Financing Statements?

If you are extending credit to your customer, you should implement a UCC filing program!

Distributors

Equipment Rental

Material Suppliers

Financial Institutions

Leasing Companies

Factoring Companies

We Have Options to Best Meet Your Needs

Whether you need a full service provider to manage the entire UCC filing process or simple want to outsource the burdensome task of processing and recording UCCs, we’ve got flexible solutions to best meet your needs.

- Essential UCC Filing Services: ideal for those who self-manage all data verification related to UCC filings and file PMSI in Equipment

- Premium UCC Filing Services: ideal for those who want a service provider to manage the entire UCC filing process

Commercial Collections Education Center

Stop Losing, Start Protecting: UCC Filings Reduce Financial Risk

Blog

NCS' Top 30 Commercial Credit Management Tips

Tips

What Is a UCC-3 and Why Would You File One?

Blog

Healthcare Bankruptcies: A Financial Risk to Suppliers

Blog

Still Using Credit Insurance? Here Are 5 Reasons to Consider UCC Filings Instead

Blog

How UCCs Can Enhance Personal Guarantees

Tips

How We've Helped Others

NCS has been a true partner to us. They truly understand our business and work closely with us on the intricacies of UCC law and how it applies to our unique situations. They are never too busy to answer our questions and their input is knowledgeable and insightful. They have helped us grow our business while properly managing our risk portfolio through their best-in-class portal and reporting tools. Highly recommend them.

We had a situation with a large volume customer with no personal guaranty who closed their doors unexpectedly…leaving us with a past due balance of $189,000…Without us being a secured creditor with a UCC filing in place, I truly believe that we would have only received cents on the dollar under the unsecured general creditors. Sysco Boston has been paid due to the utilization of the UCC and the services of NCS. NCS makes this process easy.

NCS has been outstanding with the entire process of transitioning our UCC records into their system for the filling, monitoring, and maintenance of our UCC records. Our records go back several decades; therefore, the transition has to be with a company that would help us every step of the way. NCS has exceeded all my expectations and has made our transition seamless.

NCS services have been invaluable to Kichler Lighting for many years. Since I attended an NCS seminar a number of years ago, we have done hundreds of filings and they have helped us save thousands of dollars. A number of our filings have allowed us to recover products and recoup funds that we would not have otherwise.

Using the Corporate Monitoring service NCS has been providing, our company has already identified two accounts with open credit limits which could have resulted in material losses: First, a $100,000 open credit limit and open accounts receivable. NCS identified the account as inactive with the State. Subsequent conference calls with the CFO of our customer found that the customer was “very close to running out of cash and it is unlikely to be funded further by outside investors.” Given such dire status provided verbally as well as the State standing, we reduced the limit to $0. Second, a $250,000 open credit limit. NCS identified the account as inactive with the State. HTA had no open exposure and decided to reduce the limit to $0 until the business returns to active status or until a sufficient explanation can be provided. As a general rule, HTA does not do business with companies that are inactive with the State without sufficient explanation and understanding.

Why Leading Businesses Trust NCS Credit

We combine powerful tools, unmatched expertise, and personal support to help protect your receivables and improve your bottom line—every step of the way.

Blanket

Purchase Money Security Interest (PMSI)

A PMSI filing provides the same benefits as a Blanket file, plus you have priority of repossession of your inventory or equipment.

Consignment

Bailment

Warehousing

A Warehousing filing protects your goods when your inventory is held at a third-party location.

Installment / Promissory Note

Read to Learn More

Filing UCCs is one of the most common trade credit practices and unfortunately there are scammers trying to take advantage. Read How to Spot an Avoid a Common UCC Filing Scam to learn more.

Education Center

Explore Expert Insights, Tools & Resources to Strengthen Your Credit Risk Strategy.

Featured Resource:

Know Your Customer. Protect Your Cash Flow in Any Economy.

Strengthen credit relationships by knowing your customer and using UCC filings & mechanic's liens. Learn how to protect your business in any economy.

Learn More

Know Your Customer. Protect Your Cash Flow in Any Economy.

Strengthen credit relationships by knowing your customer and using UCC filings & mechanic's liens. Learn how to protect your business in any economy.

Why Waiting Until the 15th Risks Texas Lien and Bond Rights

Learn why mailing Texas notices of nonpayment and bond claims late risks your rights and how to adjust timing under USPS postmark changes.

USPS Postmark Changes and Preliminary Notice Deadlines

Learn how USPS first-scan postmarks affect construction notices in 2026. What credit managers need to know about mailing early and protecting lien rights.

.png?length=600&name=Alec%20Papesch%20NACM%20Credit%20Line%20Podcast%20HubDB%20(1).png)

Podcast: Technology Is Transforming Construction Credit

NCS Credit’s Alec Papesch shares how technology improves construction credit, AR visibility, and lien rights on NACM Connect’s Credit Line Podcast.

Lien Index Q4 2025

Explore lien filing trends and insights from Q4 2025 to stay informed on construction credit and payment activity across the U.S.

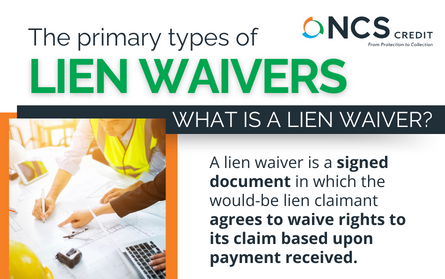

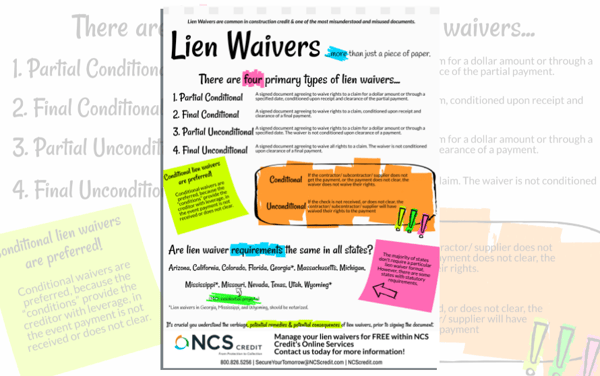

Lien Waivers in Construction: The 4 Primary Types

Understand the four main lien waiver types (partial/final, conditional/unconditional) so you protect payment rights and avoid costly mistakes.

What Is a UCC Termination and How to Avoid Costly Errors

Understand UCC Terminations, UCC-3 filings, who can terminate, and common errors that can wipe out security interests and payment priority.

Serve Preliminary Notices via Certified Mail

We always recommends serving preliminary notices via certified mail with return receipt requested. The additional cost to add “return receipt” is significantly less than potential court costs & time...

NetNow Partners with NCS Credit

NetNow and NCS Credit launch an integration that brings notice, waiver, and lien tools into one platform to improve efficiency and protect payment rights.

What Is a Bankruptcy Proof of Claim?

Learn about bankruptcy proof of claim, its importance, and filing process.

UCC Filings: Common Forms & Types

Learn about UCC filings, including UCC-1, UCC-3, UCC-5, and UCC-11 forms. Understand key filing types and how each protects creditors.

Chapter 7 vs Chapter 11 Bankruptcy

Learn the key differences between Chapter 7 and Chapter 11 bankruptcy for businesses.

Understanding UCC Filings: Top Questions Answered

Learn UCC filing deadlines, validity, continuations, amendments, collateral descriptions, and subordination rules to protect your secured creditor rights.

Lien Waiver Process with Automation and Expert Oversight

Simplify lien waivers with automation and expert oversight. Reduce errors, speed payments, and protect rights with a clear, reliable process.

What Is a Lien Waiver in Construction

Lien waivers are one of the most popular documents within construction credit. We’ve compiled a list of the top 10 lien waiver questions.

Preliminary Notices: What Are They?

Learn what preliminary notices are, why they matter, and how they protect your lien and bond claim rights in construction projects.

What is a Bond Claim?

What is a bond claim? Whose bond are you going to claim against? Can you only claim against a bond if it is a public project?

What Is The Federal Miller Act

The Miller Act is the federal payment bond statute that requires GCs to furnish payment bonds on projects contracted by the United States.

Lien Waivers: What They Are Used for & How

Learn what lien waivers are, how they work in construction, and why they protect both payment rights and project relationships.

Commercial Collections: What They Are & How They Work

Learn what commercial collections are and how prompt, professional recovery protects your bottom line and preserves partnerships.

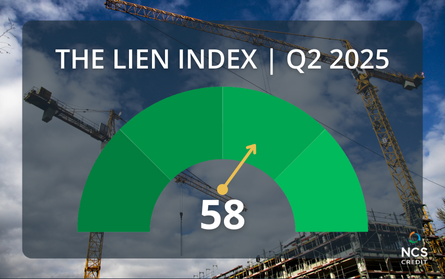

Lien Index Q3 2025

The Lien Index fell 16% in Q3 2025, signaling shifts in construction activity as contractors adapt to changing economic and labor conditions.

What Is a UCC Filing?

A clear guide to UCC filings: what they are, how they work, and how they protect creditors’ rights and reduce risk in commercial transactions.

Texas Preliminary Notices Are for Non-Payment

In Texas, preliminary notices follow non-payment. Learn how to protect your lien and bond claim rights with correct timing and compliance.

Lien Index Q2 2025

Lien activity down 3% in Q2 2025 as contractors faced cash flow issues, bankruptcies, and labor shortages; see top states & regional trends.

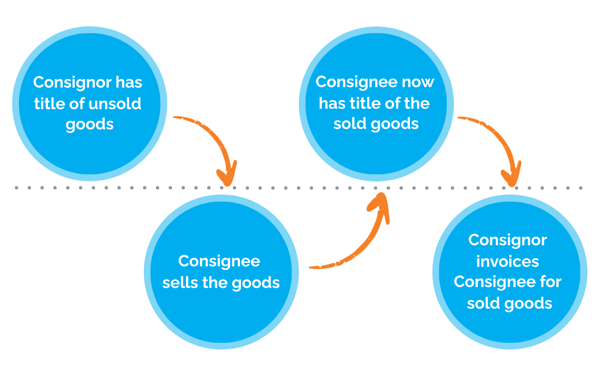

The Difference Between Consignment and Bailment

For creditors, Consignment and Bailment transactions get a little fuzzy. In this infographic we'll compare Consignment and Bailment and offer some best practices for you when securing your...

White Paper: UCC Filing and Customer Default

If you’ve filed a valid UCC-1, have a signed contract, and accurately described your collateral, you’re in the driver’s seat when a customer defaults. You don’t have to beg for payment or write off...

Suppli Partners with NCS Credit

Suppli partners with NCS Credit to integrate LienFinder™, giving users real-time lien data and credit insights to reduce risk and streamline collections.

Alec Papesch on The Credit Line Podcast

Alec discusses the role of technology in credit management and the future of the credit profession.

Purchase Money Security Interest and Super-Priority

Secure your payments with Purchase Money Security Interest filings and super-priority status. Learn how to protect your assets and get paid.

StorONE’s NVMe Technology to Power Leading Credit Company’s Storage Needs

NCS Credit deploys StorONE’s high-performance storage platform, boosting efficiency, scalability, and data protection for credit and lien services.

Business Bankruptcies Are Rising; Time to Protect Your A/R

Business bankruptcies are rising across industries. Learn how UCC filings and mechanic’s liens can help you recover payment.

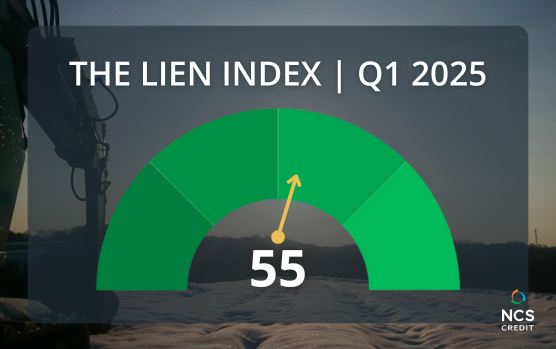

Lien Index Q1 2025

Lien Index down 5 points from Q4 to 55. Mechanic’s Lien activity has declined, but forecasted to increase in coming quarters.

Mechanic's Lien: What, How, and Why?

A comprehensive guide on mechanics liens, their purpose, process, and significance in safeguarding your financial interests on construction projects.

UCC Filing Myths

Dispel the myths surrounding UCC Financing Statements and how they can benefit your credit process. Expert insights from NCS Credit.

Attorney Services Tips for Credit Professionals

Struggling to manage A/R and past-due accounts? In this video, we’ll share key best practices to help you determine when it’s time to turn to us for expert support.

Infographic: Most Common UCC Filing Myths

Sometimes UCC filings get a bad rap because of common myths like "I'll always be behind the bank." So we've rounded up some of the top myths and our UCC experts have busted them!

Construction Litigation Attorney

Selecting the right attorney for construction litigations can impact your ability to secure receivables. Learn how to weigh your options.

Payment Protection Rights for Los Angeles Wildfires

Importance of protecting payment rights for material suppliers & subcontractors in the aftermath of the Los Angeles fires.

Reduce the Need for Collections with UCC Filings

Learn how UCC filings can reduce collections, secure your accounts receivable, and enhance your financial position as a creditor.

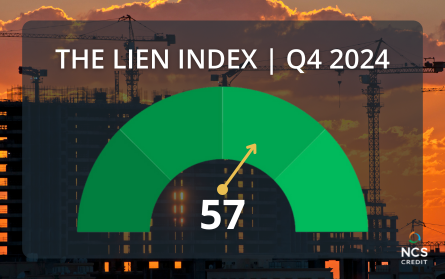

Lien Index Q4 2024

Slow payments continue to plague the industry, as the Lien Index Q4 2024 declined to 57, a 4 point drop from Q3 2024.

Preliminary Notices 101: A Beginner’s Guide

New to mechanic's lien and bond claim rights? Here's the top info you should know about preliminary notices.

Navigating Credit Trends in 2025

Credit will be shaped by tech innovations, regulatory changes, & evolving economic policies. Learn more about navigating credit trends in 2025.

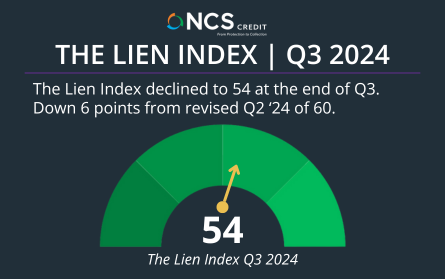

NCS Credit Lien Index Q3 2024

The Lien Index declined to 54 at the end of Q3, down 6 points from the revised Q2 Index of 60 and down 4 points over Q3 2023.

White Paper: UCC Filings a Secured Transactions Overview

Download this paper to learn more about the scope of Article 9, including conveying a security interest and perfection, security interest priorities, defaults, and remedies.

Past-Due Accounts: Collection Agencies vs. Write-Offs

NCS Attorney, Michelle Gerred discusses why you should use a contingent collection service before writing off bad debt.

How to Spot and Avoid a Common UCC Filing Scam

Filing UCCs is one of the most common trade credit practices! Unfortunately, there are scammers that aim to take advantage. Learn how to spot a scam.

Unlock the Power of Mechanic's Liens

In this article, we’ll review what the mechanic’s lien process is and why it’s important to your credit management process. You too can unlock the power of mechanic's lien and get paid for the work...

NCS Credit Joins the Equipment Leasing & Finance Association

NCS Credit joins the Equipment Leasing & Finance Association, strengthening its commitment to UCC filing excellence and the equipment finance industry.

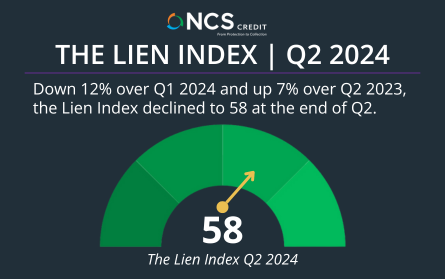

NCS Credit Lien Index Q2 2024

The Lien Index declined to 58 at the end of Q2, down 8 points from the revised Q1 Index of 66 and up 4 points over Q2 2023.

NCS Credit Joins American Rental Association

NCS Credit joins the American Rental Association, reinforcing its commitment to supporting the rental industry with expert credit management solutions.

Primary Types of Lien Waivers

This infographic reviews the fundamentals of conditional, unconditional, partial, and final lien waivers. Ready to learn more about the primary types of lien waivers and which waiver could provide...

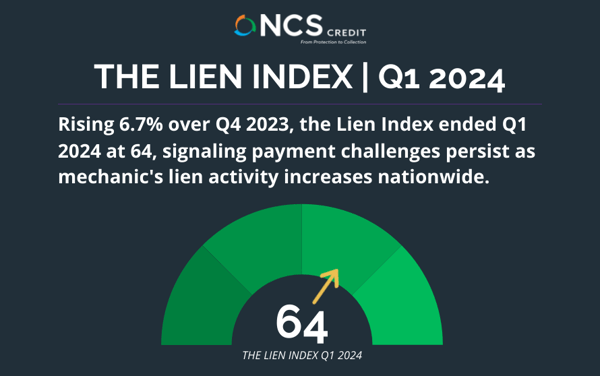

NCS Credit Lien Index Q1 2024

Rising 6.7% over Q4 2023, the Lien Index ended Q1 2024 at 64, signaling payment challenges persist as mechanic's lien activity increases nationwide.

Bectran and NCS Credit Lien Management Integration

Streamline your construction credit process with the Bectran and NCS Credit integration. Automate lien management, protect payments, and save time.

Healthcare Bankruptcies: A Financial Risk to Suppliers

Learn how creditors providing everything from basic office supplies to extensive operating room equipment have an opportunity to file a UCC to recover funds and repossess equipment.

UCC Filings Reduce Financial Risk

In this resource, we discuss what is a UCC filing and who should file UCCs, top UCC filings myths debunked, UCC filings vs. credit insurance and the competitive advantage of UCC filings.

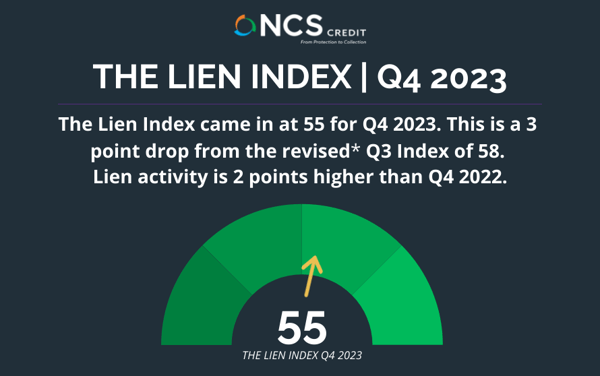

NCS Credit Lien Index Q4 2023

The Lien Index came in at 55 for Q4 2023. This is a 3 point drop from the revised Q3 Index of 58. Lien activity is 2 points higher than Q4 2022.

Rental Equipment in Pennsylvania: The UCC Filing Advantage

Review this recent Pennsylvania legal decision and how UCC filings are poised to be the payment leverage rental equipment companies need.

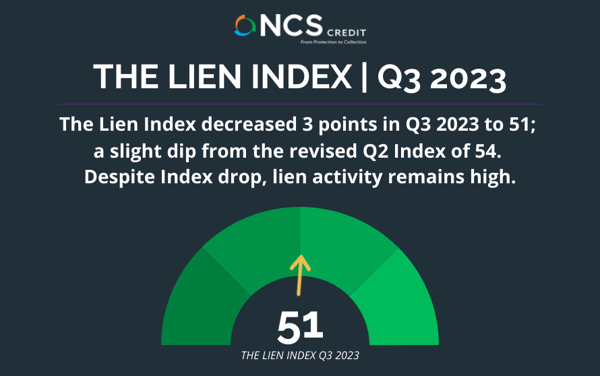

NCS Credit Lien Index Q3 2023

The Lien Index decreased to 51 in Q3. The decrease comes on the heels of a revised rate of activity for Q2 2023, in which the Index increased from 47 to 54.

Changes to Florida’s Lien and Bond Claim Laws

Florida passed House Bill 331 (effective 10/01/2023) which revised mechanic’s lien and bond laws. Read today's post to learn more.

Help Your Customer Understand UCC Filings

Filing UCCs? Send your customer this letter to help them better understand the UCC filing and how it impacts them.

Comparing USA's UCC & Canada's PPSA

Compare Canada’s PPSA and the U.S. UCC - see how each handles filings, priority, and defaults to navigate secured transactions.

Serve the Preliminary Notice Upon the Construction Lender

You serve preliminary notices to protect lien rights. Did you know some states require the lender also receive a copy of the notice?

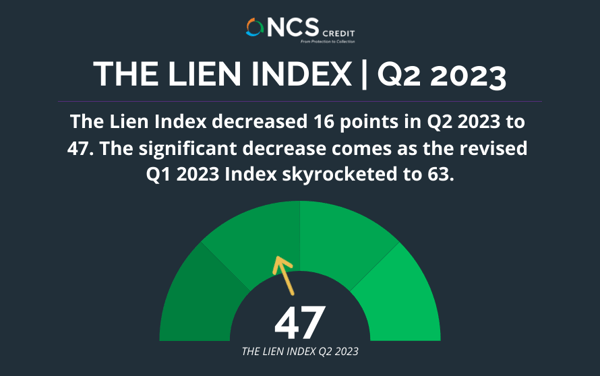

NCS Credit Lien Index Q2 2023

The Lien Index decreased 16 points in Q2 2023 to 47. The significant decrease comes as the revised Q1 2023 Index skyrocketed to 63.

The Shift from Credit Insurance to UCC Filings Explained

While insurance companies deliver crippling blows to businesses’ financial security, credit departments bring UCC filings into renewed focus.

Selling on Consignment and UCC Filings

In consignment filings, the consignor of the goods remains the title holder until the consignee sells the goods – once the consignee sells the goods, the consignee obtains the title, which triggers...

Serve the Lender with the Notice

A lender is the party (or parties) funding the project. Often the lender is a financial institution, but sometimes, especially in the case of P3s, the lender may be a corporation or other entity.

Look Out for These Common UCC Security Agreement Mistakes

Discover five essential requirements to perfect your UCC security interest and avoid the most common errors in debtor names, collateral, and documentation.

Bankruptcy Proof of Claim: Don't Forget!

With bankruptcies on the rise, it is increasingly likely you'll need to complete a bankruptcy proof of claim. Learn more in this post.

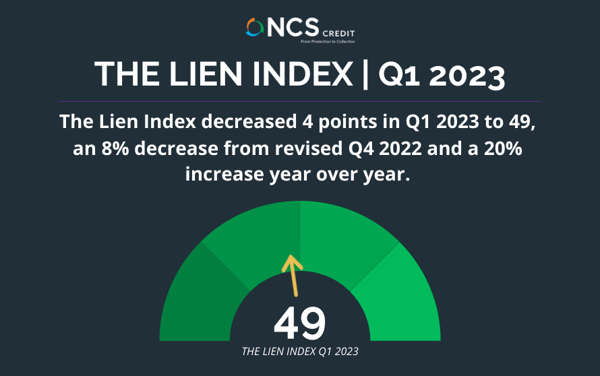

NCS Credit Lien Index Q1 2023

The Lien Index decreased 4 points in Q1 2023 to 49, an 8% decrease from revised Q4 2022 and a 20% increase year over year.

Statute Changes for New Mexico Mechanic's Liens

Under New Mexico's revised statute, to recover costs and fees, you need to serve a copy of the recorded mechanic’s lien upon the owner.

New Mexico Lien and Bond Claim Rights

Curious about mechanic’s lien & bond claim rights in New Mexico? Today's post is for you because we’re in a New Mexico state of mind!

UCCs Reduce Risk for Creditors in Foodservice Industry

If you're supplying goods, equipment, or services to the foodservice, beverage, or hospitality industries, you are faced with a unique set of credit challenges.

Contingent Payment Clauses

Pay-If-Paid and Pay-When-Paid are contingent payment clauses. But what's the difference between the two and are they enforceable?

What Happens to Bond Claim Rights When a Notice is Served but Not Received

What happens to payment bond rights when the required preliminary notice is served but never received? One lucky claimant found out.

Blanket Filing or PMSI Filing

A creditor can file a PMSI and Blanket Filing on the same collateral. Unsure which filing your company should be doing?

Obtain a Copy of The Payment Bond

Getting a copy of the bond up front is prudent. As a best practice, obtain a copy of the payment bond when contracting for the project.

The Competitive Advantage of UCC Filings

UCCs create opportunities. UCCs offer additional security, which means you could sell to marginal accounts that were previously out of reach.

North Carolina Mechanic’s Lien Rights: What is a Lien Agent?

Learn about North Carolina lien agents. Learn their roles, responsibilities, and how they impact your construction projects!

NCS Credit Lien Index 2022 Q4

The Lien Index increased 3 points in Q4 2022 to 47, a 7% increase over Q3 2022 and 34% increase year over year.

Safe Harbor Won't Save Your Florida UCC

Safe Harbor couldn't save this UCC. Florida's 'zero tolerance' policy means you must strictly comply with Article 9-503(a). Learn more here!

NCS Credit Lien Index 2022 Q3

The Lien Index increased 4 points in Q3 2022, an 11% climb over Q2 2022. As expected, Q3 mechanic's lien activity rose 11% over Q2, and activity remained lower than Q1, which peaked at 43.

Perfecting Security Interests: Avoiding Improper Forms

When preparing documentation to perfect a UCC filing, the requirements may not be too complex, but you must strictly follow the requirements.

Special Types of Liens: Oil and Gas Liens

The question: “Are there special types of mechanic’s liens?” The Answer: YES! Some include Oil, Gas, Mineral, Wells, and Quarries.

UCC Filings: Does DBA Matter?

The most common UCC filing mistake is incorrectly identifying the customer. A misspelling could hurt your security, learn more here.

NCS Lien Index 2022 Q2

The Lien Index decreased 8 points in Q2 2022, a 19% drop over Q1 2022. Despite the significant drop in mechanic's lien filings in Q2, the overall activity level is average for this time of year.

Importance of Writing Effective UCC Collateral Descriptions

A UCC must include a description of property serving as collateral. Find out how being too vague or specific could jeopardize your security.

The Importance of Project Type for Lien Rights

Learn more about the critical role project type plays in protecting your mechanic's lien and bond claim rights.

Protect Your Purchase Money Security Interest in Goods

A perfected PMSI can give you priority in goods. But what happens when you don't perfect your PMSI? Read this post to learn more!

What's Included in a California Mechanic’s Lien?

Today’s post is for all you DIY-ers. Here’s a breakdown of the information you should include within your California mechanic’s lien.

Bonding Off a Mechanic’s Lien: What Is It?

Bonding off a mechanic’s lien doesn't mean your mechanic’s lien rights are gone. check out this post to learn what you'll do instead.

Georgia Mechanic’s Liens & Bond Claims

Furnishing to a project in Georgia? Check out these steps to protect your mechanic's lien or bond claim rights for projects in Georgia.

Non-Statutory Notices: 3 Great Reasons to Serve Them

No required preliminary notice to protect mechanic's lien rights? You should serve a non-statutory notice and we have 3 great reasons why!

Bankruptcy Proof of Claim Is Late

When the bar date is set, you’d better have a good excuse for missing it, because a deadline is a deadline. Careful, don't lose your claim!

Bectran and NCS Partnership Brings Integrated UCC Solutions

Empower your credit team with the Bectran & NCS Credit UCC filing solution. Automate asset-backed credit monitoring, reduce risk, & streamline your workflow.

NCS Lien Index 2022 Q1

The Lien Index's rate of increase slowed from an adjusted +22% in Q4 2021 to +13% in Q1 2022.

Material Suppliers' Mechanic's Lien Rights in Indiana

In a significant legal reversal, a material supplier selling to a material supplier now has mechanic’s lien rights in Indiana. Check it out!

Common Words in Mechanic's Liens and Construction Credit

Every business has its own keywords, phrases, and acronyms. Here are some of the most common terms you may hear in mechanic's liens & construction credit.

When Should the Clerk Record the Mechanic's Lien?

This decision, while victorious for the lienor, is a great reminder to always confirm your document has been received AND recorded timely.

Changes to North Carolina Lien Waivers

North Carolina lien waivers on progress payments are only enforceable for the amount/payment actually received. Awesome news!

Mechanic’s Liens and Construction Credit, Common Terms

Here are some of the most common keywords and phrases you may hear in the land of mechanic’s liens and construction credit.

NCS Lien Index 2021 Q4

The Lien Index jumped to 19.7% in Q4. Throughout Q4, national mechanic’s lien activity rose across all regions, though most significantly in the Midwest.

Four Reasons We Love UCC Filings

Here are four reasons we love UCC filings and you should too! Plus a bonus 5th reason - check out this post for details!

New Brunswick Mechanic’s Lien Changes

Here’s a brief look at some key changes to New Brunswick mechanic’s lien statute, which came into effect toward the end of 2021.

States that Require Lien Waivers to be Notarized

Question: “Does this lien waiver have to be notarized?” Answer: “Yes, in Georgia, Mississippi, and Wyoming.” Let’s review!

Mechanic’s Liens on Arkansas Residential Projects

Learn how one residential contractor could have saved thousands of dollars if they would have served their preliminary notice.

Safe Harbor Might Save One Creditor's UCC Filing

A $3M reminder to always list your customer’s name on the UCC as their name appears on the public organic record.

Mechanic’s Lien on a Wind Farm Can Be Complicated

Supplying materials or labor to a wind farm project? Keep these 7 things in mind when filing your mechanic's lien.

North Dakota Mechanic’s Lien and Bond Claim Rights

What do North Dakota and mechanic’s liens have in common? They are both legendary! Let’s check out North Dakota mechanic’s lien rights.

Bankruptcy Proof of Claim: What if It's Late?

And just like that, the creditor’s claim for $169,569 was not entitled to distribution, because it was filed a day late. Ouch!

Texas Mechanic’s Lien Statute Changes

Here’s a look at the Texas statutory changes effective for general contracts executed on or after January 1, 2022.

Nebraska Construction Lien and Bond Claim Rights

Furnishing to a project in Nebraska? Read this post to learn more about securing construction lien and bond claim rights.

What Is a UCC-3 Filing and Why Should You File One?

A UCC-3 can wear many hats. It can be used to continue, amend, or terminate your UCC filing. Learn more about the UCC-3 and its role in your security interest.

NCS Lien Index 2021 Q3

The Lien Index increased slightly to -9.03% in Q3, up approximately .5% over Q2.

Serve and File the Mechanic’s Lien

What happens if you file your mechanic’s lien, but don’t serve the lien on the appropriate parties? Your lien may be invalid - learn more!

Indiana Material Supplier Gets a Win in Appeals Court

A case that started as “material supplier to material supplier” shifted to “material supplier to subcontractor” - what happens to the lien?

Security Interest Survives Crazy Collateral Transfers

This case is a little crazy and convoluted, but the takeaway is strong. A security interest will survive, if properly perfected.

Utah Mechanic’s Lien and Bond Claim Rights

Furnishing to a construction project in Utah? Today’s post is just for you as we explore Utah mechanic’s lien and bond claim rights.

Mechanic’s Lien Rights in Canada at a Glance

Did you know Canadian provinces have their own lien and bond claim statutes? Let’s review the steps for securing lien rights in Canada.

EC: Is the Project Private, Public or Federal?

In this NCS Extra Credit installment, Nadia Grabowski (Notice & Lien Specialist) discusses the importance of identifying the correct project type.

Add a Check to Your Mechanic’s Lien Checklist

Did you know your lien could be rejected by the recording office if you don't provide a check for the exact amount of the recording fees?

Payment Bonds and Bond Claims

Learn who is a party to the payment bond, who is protected by the payment bond, how to know whether a payment bond has been issued, and when and how a bond claim should be served.

NCS Lien Index 2021 Q2

The Lien Index decreased 9.6% in Q2, following two quarters of increased mechanic’s lien activity (Q4 2020 and Q1 2021).

Is the Lien Consensual or Statutory?

There are 2 types of liens creditors may use: consensual or statutory. Check out this post to learn what the difference is & why it matters.

Podcast -- "Adapting to the Pandemic"

In this NCS Extra Credit Podcast premier, Don Provident (NCS Marketing Manager) and Amy Poje (Director of Operations) discuss how NCS has adapted to best serve clients during the pandemic.

Compliance with UCC 9-503(a) when Filing UCC in Georgia

Compliance with UCC 9-503(a) must be one of the easiest and most challenging aspects of perfecting security interests. Let's see why!

CMC: Customized Preliminary Notice and Bond Claim Solution

Overwhelmed and tangled in a spreadsheet mess, missing deadlines, and losing bond claim rights? Find out how we've helped others exactly like you!

UCC Filings Work, Here's a $95,000 True Story

Did you know you could potentially recover funds from unsecured creditors who were paid with funds secured by collateral identified in your UCC?

Commercial Credit Management Tips

Download this e-book to read 30 of our top commercial credit management tips from our Collection, UCC filing, and Notice & Mechanic's Lien Services.

Legislative Updates in Construction 2021

In 2021, several states enacted legislative updates to their mechanic’s lien and bond claim statutes. Here’s a quick recap of changes.

Preliminary Notices on Private Projects

View this reference to see which states require you to serve a preliminary notice before you can file a mechanic's lien.

Survey: Securitization on A/R During the Pandemic

The CRF surveyed the use and impact of securitization (UCCs, mechanic’s lien, etc.) on A/R during the pandemic. Here's what they found.

Arkansas Lien & Bond Law Changes in 2021

Learn more about the changes for Arkansas residential mechanic’s liens and payment bonds for public projects.

UCC 9-503(a) and a Creditor’s Security Interest

The spelling of your debtor's name on the UCC filing matters. Welcome to today’s edition of “The Tractors & Tribulations of UCC 9-503"!

Changes for Texas Lien Claimants Effective January 2022

Big things are happening in the great state of Texas, including changes to their mechanic's lien and bond claim laws. Let's review!

NCS Lien Index 2021 Q1

After a turbulent 2020, the NCS Lien Index (LI) reflected some return to normalcy in the latter quarters of 2020 and Q1 2021.

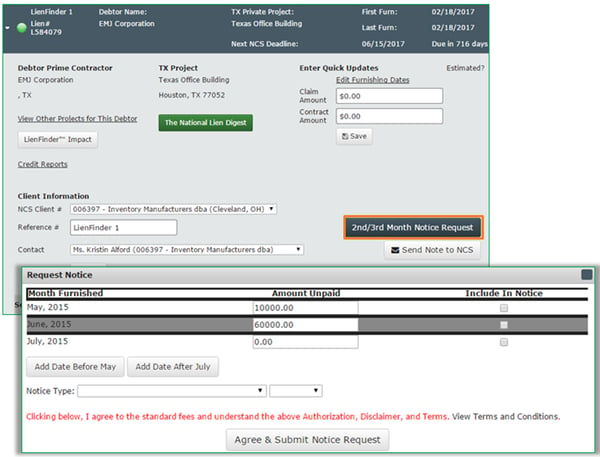

The NCS Software Suite -- Online Services

NCS Online Services is consistently updated for the best user experience. We have integrated our three service groups, our technical applications, and our analytical services in one central location.

Changes to Iowa Mechanic’s Lien Law in Effect January 2022

There are some changes coming to Iowa's mechanic's lien and bond claim statutes. Here's what you should know!

New York Tolling the Lien Line

A lien claimant's lien was saved because the deadline was tolled. What is tolled and how did this claimant luck out? Let's take a look.

Lien & Suit Deadlines for Private Projects

Download this 50-state quick reference guide for mechanic's lien and suit deadlines for both commercial and residential private projects.

Wyoming House Bill Further Defines a Digital Asset

Wyoming recently defined a digital asset and identified it as an intangible under UCC Article 9. That means a UCC filing could protect you!

Bond Claim & Suit Deadlines for Public Projects

Download this 50-state quick reference guide for bond claim and suit deadlines for public projects.

Minnesota Prelien Deadline is 45 Days, Not 72 Days

What happens when your preliminary notice is late? In Minnesota, you may lose your mechanic’s lien rights. Here's what you should know.

Notice Deadlines for Private Projects

Download this 50-state quick reference guide for preliminary notice deadlines for private commercial & residential projects.

Warranty Work Doesn't Extend Washington Lien Deadline

We are frequently asked whether punch list or warranty work will extend the mechanic’s lien deadline. Let's see what Washington thinks.

Construction Project Liens: Federal, Public, or Private

Did you know a project could be more than private, public, or federal? How about quasi, leasehold, or sovereign? Learn more here.

UCC Terminated without Authorization

To have a UCC filing terminated without authorization is unfortunate; to have it happen twice? Well, that’s downright frustrating. What now?

Notice Deadlines for Public Projects

Download this 50-state quick reference guide for preliminary notice deadlines for public projects.

Can You Revive a UCC Filing?

Can a UCC be “revived” if you knowingly fail to timely file an amendment for a debtor’s name change? Odds aren't good! Let's learn more here.

Loves Furniture Bankruptcy & Mechanic's Liens

What does Loves Furniture bankruptcy have in common with Michigan's mechanic's lien law? Here's a hint: a mechanic's lien could protect you.

5 Reasons to Consider UCC Filings Instead

Insurance companies deliver crippling blows to businesses’ financial security, credit departments have been carefully reevaluating risk mitigation strategies, and it’s brought UCC filings into...

Mechanic’s Liens & New Jersey’s American Dream

It is reportedly 3 million square feet, it's been decades in the making and with millions in mechanic’s liens, it’s not done yet.

Notices of Commencement: Top 7 Questions Answered

What is a Notice of Commencement? Do all states have Notices of Commencement? Why are these documents important? Answers are here!

NCS Insights for Credit Management in 2021

Bankruptcy Climate of 2020, Predictions for 2021, and What You Need to Do to Ensure Your Company is a Secured Creditor

Serve Your Pennsylvania Mechanic's Lien as Statute Dictates

Pennsylvania takes mechanic's liens statutes seriously. Learn how seriously when you read today's post about one creditor's costly mistake.

Wisconsin Construction Project for HARIBO Group

If you are contracted to perform work or supply materials to this delightful factory, don’t forget to secure your mechanic’s lien rights.

All Lien Waivers Aren't the Same

Did you know, there are different types of lien waivers? There are four primary types of lien waivers: partial conditional, final conditional, partial unconditional, and final unconditional.

Malls and Tickle-Up Effects of Retail Bankruptcies

Retail bankruptcies are on the rise and the impacts aren’t limited to suppliers of inventory and the retail employees. Who else is in danger?

The Path to BioFuel is Paved with Mechanic’s Liens

Over $15M in mechanic’s liens filed in 2020, $4.5M were filed between July and September 2020, construction and unpaid claims continue.

Georgia Lien Waivers: Changes Coming 2021

You may have heard there are changes coming to Georgia lien waivers. In today's post we'll review the key changes & what you should know.

The DeLaval Story: Successful Collection Leveraging a UCC

Read about how we helped DeLaval recover owed money from a company that filed for Chapter 11 bankruptcy protection.

$145M Waterfront Redevelopment, $5.7M in Mechanic’s Liens

A destination waterfront redevelopment with apartments, stores, restaurants, office space, and a few million dollars in mechanic’s liens.

You Received a Notice to Commence Suit, Now What?

You filed a mechanic's lien and then got a Notice to Commence Suit. What is it? Should you ignore it? Should you act? We've got the answer.

UCC Filing: Right of Repossession Without a Breach

Can you afford the risk if one of your customers defaults? What if 5 of your customers default? Don’t get burnt – get the dough! File a UCC.

Oceanwide Plaza in Los Angeles Buried in Mechanic's Liens

A GC is owed over $200M, and various subcontractors are owed an additional $2.5M, after furnishing to a project owned by Oceanwide Plaza LLC.

Equipment UCC Filings Best Practices

Selling equipment? You should consider protecting your receivable with a Purchase Money Security Interest (PMSI) filing. Here's why!

Out of Shape? The '24 Hour Fitness' Financial Failure

24 Hour Fitness bankruptcy isn't a surprise, but it does make the filing of mechanic’s liens extremely important.

Indiana Mechanic's Liens Require Two Notarizations

No, you're not seeing double. Filing an Indiana mechanic's lien? Look out for two separate notary sections.

Pandemic and Mechanic's Liens Hurting Yardbird

Unfortunately, the recently debuted Dallas location of Yardbird is burdened with some hefty mechanic’s liens; over $2.4M.

Key Changes to Tennessee’s New Construction Statute

Statute changes include additional prompt pay provisions, implementation of a new stop work notice, and a demand for reasonable assurances.

Your Credit-Granting Processes & COVID-19

We recently asked our clients whether the pandemic is impacting credit-granting processes & the proactive steps they're taking to secure A/R.

Legislation Updates for Wyoming, Utah & Virginia

There have been mechanic’s lien and bond claim legislation updates for Wyoming, Utah & Virginia. Here’s a quick rundown of the changes.

Wisconsin Lien and Bond Claim Rights

Furnishing to a private construction project in Wisconsin? Let’s review mechanic’s lien, bond claim, and lien on funds rights!

Watch Your Language, Your Lien Waiver Language

Lien waiver language is easily overlooked or ignored, despite its critical role in your mechanic’s lien rights. Let's review waivers!

No Ownership, No Lien in North Carolina

What happens if you are furnishing to a project and the party that hired you doesn't actually purchase the property you were hired to improve?

Construction Notice of Delay and COVID-19

Are you furnishing to a construction project? If so, should you send a Notice of Delay? We recommend that you and your legal team review your contracts to determine whether a Notice of Delay is...

What Happens if You List the Wrong Debtor Name in Kansas?

The details of Kansas UCC filings could be the difference in recovering hundreds of thousands and collecting pennies, or worse.

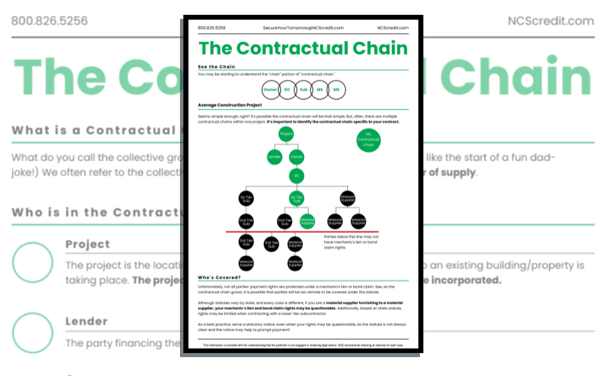

The Contractual Chain

Who is in the contractual chain? What is privity of contract? Who's covered by mechanic's lien and bond claim rights? Get answers here!

Personal Guarantee Enhanced by UCC Filing

PGs are an effective and popular credit tool; however, there are some things to take into consideration. Here's what you should consider!

Your Credit Management Arsenal & COVID-19

If you extend credit, you are vulnerable to risk. This vulnerability grows exponentially in the midst of tragic events, such as the pandemic.

UCC Collateral Description: What You Should Include

A perfected security interest is nothing without a collateral description. So what info should you include in your collateral description?

Public Projects & Preliminary Notices

Do you know there are 19 states that require a preliminary notice be served to protect bond claim or public improvement lien rights?

Who Signs the New Jersey Preliminary Notice

Did you know you could lose mechanic’s lien rights if the person signing the lien isn't authorized to do so? Check out this case.

Preconstruction Management Services Lienable In NY?

What are preconstruction management services? Can you file a mechanic's lien if you aren't paid? In New York, it's a solid maybe.

Commercial Credit Management Tips for Notices & Liens

It’s part three of our Commercial Credit Management Tips! We've covered tips for Collections and UCCs. Today we wrap up with Notices & Liens.

UCC Filings Protect those Supplying to Healthcare Industry

Download this resource to learn more about the financial risks suppliers face when bankruptcies hit the healthcare industry and what you should do to protect your company.

Commercial Credit Management Tips for UCCs

It’s part 2 of our series of Commercial Credit Management Tips. Previously, we shared Collections tips, today let’s review UCCs.

Backup Documentation Can Make or Break Your Claim

Maintaining comprehensive and complete records can be a challenge. But, if you skip the back up documentation you risk your lien rights.

Louisiana Mechanic's Lien Changes Are in Effect

Let’s take a deep dive and review what you should know about the Louisiana mechanic's lien changes which became effective 1/1/2020.

Texas Construction: Public Projects Notices & Bond Claims

Furnishing to a public project in Texas? Well saddle up! Let’s review the notice and bond claim requirements for Texas public projects.

Pennsylvania Construction Notices & SCCM Numbers

Pennsylvania State Construction Notice Registry: what is a SCCM number? Why does it matter? Find the answers here!

Critical Question About Condominiums & Mechanic's Liens

Did you improve a unit or a common area? One of the most important questions if you need to file a mechanic's lien on condominiums.

Commercial Credit Management Tips for Collections

In this three-part series, we will review our favorite tips for Collections, UCCs, and Notices & Liens. Up first? Collections!

Arkansas Mechanic’s Lien and Bond Claim Rights

What do diamonds and Arkansas mechanic's liens have in common? If you are furnishing to an Arkansas construction project, this post is for you!

Personal Guarantees vs UCC Filings

In this NCS Extra Credit installment, Jerry Bailey (Executive Sales & Education Services Manager) compares personal guarantees and UCC filings.

EC: Understanding 1st Furnishing, Last Furnishing & Completion

In this NCS Extra Credit installment, Heather McLaughlin (Notice & Mechanic's Lien Specialist) explains 1st furnishing, last furnishing and completion.

Lien Right Consequences of Late Notices in West Virginia

What are the consequences to your lien rights if you fail to serve the notice for a West Virginia Mechanic's Lien on time? Find out here!

Mechanic’s Lien & Bond Claim Rights in Kansas

Are you furnishing to a construction project in Kansas? This post is just for you! Learn all about Kansas mechanic's lien & bond claim rights.

The Retail Bankruptcy Apocalypse

Retail bankruptcies are, without question, harmful to creditors. What can you do to protect your business from retail bankruptcy?

Fabricated Invoice Date Leads to Invalid Mechanic's Lien

Thinking of changing an invoice date to extend a lien deadline? It's tempting to alter the date, but don't do it. You could lose your lien.

What Information Should You Include In Lien Waivers?

Before you sign that lien waiver, are you sure it has all necessary info? Here's what information should be included in a lien waiver.

EC: Residential Projects and Lien Rights

In this NCS Extra Credit installment, Marla Zurlo (Senior Account Representative) reviews mechanic's lien rights on residential projects.

Changes Ahead for Louisiana Mechanic’s Lien Rights

Louisiana’s 2019 legislative session included the passage of HB 203. Let’s review the calculation of mechanic’s lien deadlines.

Idaho: Lien & Bond Claim Rights in the Gem State

Today's post is a GEM! We'll review mechanic's lien and bond claim rights for construction projects in Idaho.

Rhode Island Mechanic's Lien Rights are Mighty

Rhode Island may be the smallest state in land size, but Rhode Island means business for mechanic's lien & bond claim filers.

Recap of Changes to Ontario’s Construction Lien Act

Over the last two years we have discussed the changes to Ontario’s Construction Lien Act. Here’s a breakdown of what you should know.

Canada: Provincial Construction & Your Payment Rights

A provincial project is the improvement of public works or building under contract made by the provincial government. Time for a bond claim?

Miller Act Bond Claim: Miss 1 Day, Lose $8M

Miss the Miller Act Bond Claim deadline by a day and lose the right to recover a claim amount of over $8M. Ouch!

Not a Secured Creditor? Aim To Be Critical Vendor

It's best to be a secured creditor. But, if you don't file a UCC or mechanic's lien, all hope's not lost - you could be a critical vendor.

EC: Properly Perfected UCC and Repossession

In this NCS Extra Credit installment, Diane Toth (UCC Specialist) answers “Can a properly perfected UCC really give me the right to repossess?”

Mechanic's Lien Rights in Alabama

“Sweet Home Alabama, where liens are so due” isn't as good as the original, but today's post about Alabama lien rights will make up for it.

It’s A 180 On The 180 Equipment, LLC Decision

Planning to attach the collateral description when you file your UCC? One creditor lucked out when the Court of Appeals ruled in their favor.

What's New in Mechanic’s Lien & Bond Claim Law?

Here are some key developments and changes to mechanic’s lien and bond claim laws in Illinois, Minnesota, Florida, and Oklahoma.

Public Projects and Preliminary Notices

Do you know there are 19 states that require a preliminary notice be served to protect bond claim or public improvement lien rights?

Legalities of Filing a Lien During Ongoing Projects

Can I file a mechanic's lien if I'm still furnishing to the project? Wish the answer were as simple as "yes" or "no."

Avoiding UCC Filing Pitfalls: Name Accuracy Tips

Filing a UCC? List the debtor's name exactly as it appears on the unexpired driver's license - except, in this case.

Illinois Mechanic's Lien and Bond Claim Rights

Are you furnishing to a construction project in Illinois? Today's post is all about Illinois mechanic's lien and bond claim rights.

EC: Assignment of Lien and Bond Claim Rights

In this NCS Extra Credit installment, Jenna Burnett (Notice & Mechanic's Lien Specialist) discusses assigning mechanic's lien and bond claim rights.

Furnishing Labor and Performing Labor Are Different

Court of Appeals determined lien rights don’t extend to a party furnishing labor, because furnishing labor & performing labor aren't the same.

Construction Lienholder Group Wins in Bankruptcy

If ever there were a time in construction litigation for folks to put on their rally hats, it would be in the case of M & G USA Corp!

Legislative Changes in Tennessee: What Builders Need to Know

Are there changes ahead for mechanic's lien and bond claim rights in Tennessee? Let's take a look at what's in store.

The Three C's of Job Information

In this article, we will review the vital role of job information in protecting your mechanic’s lien and bond claim rights.

Virginia’s Mechanic’s Lien Form Has Changed

Virginia is for lovers of mechanic’s liens! Let's share the love & discuss the changes to Virginia’s lien form, in effect 7/1/2019.

EC: UCCs Have Priority Over 503(b)(9) Claims

503(b)(9) claims are no match for UCC filings! In bankruptcy, a properly perfected security interest, in compliance with UCC Article 9, has priority over unsecured creditors, creditors with...

Key Collection Questions & Important Documentation

These four collection questions can help you determine the best debt recovery plan for your business. Check it out!

Selling Fuel on Consignment? Don’t Forget to File a UCC!

Who has priority over the proceeds from consigned goods? Is it the bankruptcy trustee or the consignor of the goods?

Iowa Lien Attached to Building, Not Lessor's Property

Who is responsible for the costs associated with the construction of the facility, the lessor, lessee or both? Here's what Iowa Supreme Court says.

Unraveling the Mystery of Misleading UCC Filings

Who enjoys a good ol’ mystery game? Today’s mystery is why a Georgia Bankruptcy Court deemed one creditor’s UCC filing seriously misleading.

Is Mediation or Arbitration Best for Your Business?

Discover the key differences between mediation and arbitration. Learn which dispute resolution method suits your needs best.

Lien Dissolution Bond and Suit-To-Enforce Action

Learn what happened in one Massachusetts case when the lien claimant took steps to foreclose on the lien dissolution bond.

Fiber Optic Networks: Can I File a Mechanic's Lien?

Here's a few things to keep in mind if you are furnishing to fiber optic networks and whether you may have lien rights.

Let’s Talk About Commercial Bankruptcy

The more you understand about commercial bankruptcy, the greater chance of preserving your rights and ultimately receiving payment.

Arizona Preliminary Notice Changes Coming December 2019!

Here's a quick review of the big changes come to the Arizona Preliminary Notices in 2019. You'll want to bookmark this!

Always Perform A Reflective UCC Search

While performing a reflective UCC search on a Pennsylvania filing, we identified issues with Pennsylvania’s records. Here's Jerry with a recap!

Do Your Collateral Descriptions Comply with Article 9?

Collateral descriptions can be a tricky business. Using a specific address in your description? Be extra careful!

Bond Claim Nitty-Gritties: The 5 W’s and 1 H

Here's everything you want to know about bond claims. Including the Who, What, Where, When, Why, and How - let's learn more!

Consignment Creditors, Give Back the Money

Consignment creditors in the Sports Authority bankruptcy have been dealt a crushing blow with the Court’s recent decision.

Advantages of Construction Attorneys in Litigation

Let's review a few key considerations when deciding whether you should hire a construction attorney for construction litigation.

Oklahoma’s Lien & Bond Claim Requirements

In this post we’ll review the steps needed to secure mechanic’s lien and bond claim rights in Oklahoma, the Sooner State.

Condominium Act Meets Construction Act in Ontario

Let’s continue our Ontario conversation today with a quick review of the intersection of Ontario’s Condominium Act and its Construction Act.

"Pay-If-Paid" Leaves Subcontractor High and Dry

In Alabama, a subcontractor can't recover its claim from the GC's surety if the subcontract contains a contingent payment clause (pay IF paid).

Digital Assets a General Intangible under Wyoming’s UCC

Wyoming is the first state to clarify the treatment of digital assets (bitcoin) under the Uniform Commercial Code.

Washington Liens: When Frivolous is Better Than Absent!

How does a late, excessive, inaccurate lien get reinstated? Well, it’s a story worth sharing! (Spoiler: because it's not a frivolous lien!)

Not-So-Peachy Mechanic’s Lien for One New York Landlord

According to a recent decision, enforcing a mechanic’s lien on leased property in New York does not require consent of the landlord.

Retainage, Payment Bonds, and Private Projects in Texas

Did you know, if you are furnishing to a private project in Texas, you may secure mechanic's lien AND bond claim rights?

Back to Basics: Two Primary Types of UCC Filings

Let’s review two basic types of secured transactions - Blanket and Purchase Money Security Interest (PMSI) - and the benefits of each.

Close Call with Terminated UCC Filing

In a recent bankruptcy case, one creditor squeaked by and maintained its secured position despite accidentally terminating its UCC filing.

Maine Mechanic's Lien & Bond Claim Rights

Here's everything you should know about securing mechanic's lien and bond claim rights in the most northeastern state, Maine.

P3s Created by Contract, Not Statute

Generally, a Public Private Partnerships (P3s) is an agreement between a private entity & public entity for the construction of a project.

Top 5 Reasons You Should File UCCs

Are reducing your DSO, mitigating risk and improving working capital not enough reasons to file UCCs? Good thing we have 5 more reasons! Including, how UCCs can help increase your sales and how you...

Is it a Bird? Is it a Rule? It’s a Cardinal Change Order!

Change orders are common. What’s the difference between a change order and a cardinal change order? Read on to find out.

Washington Mechanics Lien and Bond Claim Rights

Are you prepared to secure your Washington mechanic’s lien, stop notice, bond claim and public improvement lien rights? Learn more here.

Michigan’s Design Professional Lien Rights Amended

Michigan amended a portion of its Construction Lien Act regarding mechanic’s lien rights & procedures for design professionals.

Tennessee Lien Rights & Everything You Should Know

Securing mechanic’s lien rights on Tennessee projects can be a challenge. Let's break down the requirements & put you on the path to payment.

Time for Preparation, There’s No Rest Post-Recession

Be prepared for the next recession. Here's a few best practices you can implement to ensure you are prepared for the next economic downturn.

There’s No Ice Cream in Bankruptcy. Wait, What?!

In bankruptcy, we frequently hear terms like preference payment, claw back, and new value. What do these terms mean? Further, what do these terms have to do with ice cream?

Arkansas: You Can’t Lien a Property You Didn’t Improve

To file a mechanic’s lien in Arkansas, the lien must be filed against property you improved. Kind of feels like a face-palm moment, right?

Approve More Small Businesses for Larger Sales

Don’t leave money on the table as a result of no-hits and thin credit records on small businesses. With a comprehensive picture, you can issue higher credit limits and minimize your risk.

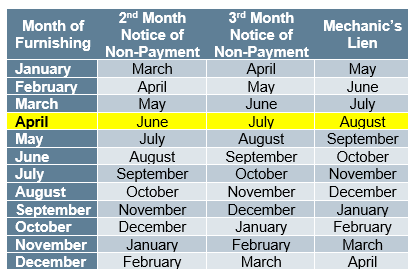

Payment Bond Thresholds

Each state has its own statutes requiring payment bonds on construction projects. Some statutes may require that the general contractor obtain a payment bond on every construction project, and other...

Which Bond is Which? Bond Types in Construction Credit

Is it a payment bond, performance bond, bid bond, contractor’s bond, prevention bond, discharge bond? And, who is a party to a bond?

Who’s on the Job? A Look at the Contractual Chain

What do you call the collective group of parties on a construction project? We often refer to the collective parties as the contractual chain or the ladder of supply.

Arbitration, Mediation, Lawsuit - What's the Difference?

Pros & cons of arbitration in construction disputes, plus the similarities and differences of arbitration and a lawsuit.

Blanket UCC Filings & Your Frequently Asked Questions

A Blanket UCC filing is a security interest in all the assets of your customer on a non-priority basis, eliminating potential conflict with your customer’s primary lender.

Mechanic’s Liens and Discharge Bonds

What do mechanic's liens, discharge bonds, and substitute teachers have in common? Check out today's post!

Louisiana Private Projects and Your Lien Rights

Here's a review Louisiana's requirements for the preliminary notice, mechanic’s lien, suit and even a bond claim.

UCC Article 9 Court Cases

In this whitepaper, we examine cases where courts are called on to determine whether a security interest has been properly perfected.

EC: Supplying Rental Equipment to a Construction Project

In this NCS Extra Credit installment, Clare Wilson (Notice & Lien Specialist) reviews how to secure your mechanic's lien rights when supplying rental equipment to a construction project.

UCCs Have Priority Over 503(b)(9) Claims

In this article, we review how 503(b)(9) claims & consignment agreements are no match for properly perfected UCC filings.

What To Do When You Can’t Get Change Orders in Writing

Change orders can be vital in supporting your claim. So, what can you do when a formal change order isn’t issued?

Montana Lien & Bond Claim Rights: What You Should Know

Furnishing to a construction project in Montana? Let’s take a look at the notice, lien, bond claim and suit requirements in Montana.

Don't Ignore Contractor Licensing Requirements

Be careful, don’t ignore contractor licensing requirements, because your mechanic’s lien rights may depend on it.

What Does It Mean to "File" a Lien?

Do you need to file a lien? Be careful, if a lien must be filed by a deadline, ensure the document is actually filed.

UCC-1 Collateral Description Reference Security Agreement

What happens when the collateral description in the Financing Statement says, “see attached Security Agreement,” but the agreement isn’t attached?

EC: The Importance of Complying with Article 9

In this NCS Extra Credit installment, Marla Zurlo (Senior Account Representative) discusses the importance of complying with Article 9.

Perfecting UCC Collateral Descriptions

A security interest is nothing without a collateral description. Take care to craft your perfectly imperfect collateral descriptions.

Miller Act May Not Cover Unused Labor

We’ve previously discussed protections under the Miller Act, now let's look at something not covered under the Miller Act: unused labor.

Backup Documentation & Mechanics Lien Filing

Backup documentation isn’t just used for preparing a document. Never underestimate the value of backup documentation and your mechanic’s lien.

An Excessive Mechanic's Lien in Nevada

How much money makes a mechanic’s lien claim excessive or frivolous? According to one Nevada court, $1,371,187.44.

Notice of Non-Payment May Not Be Required in Louisiana

For material suppliers furnishing to public projects in Louisiana, one court decided notices of non-payment aren’t required.

New York Residential Projects & Your Lien Rights

In New York, the deadline to file a mechanic's lien on a commercial project is different than for a residential project. Learn more here.

Guide to Managing Mechanic’s Liens Across Multiple Sites

We are often asked whether a single mechanic’s lien can be filed on multiple buildings or parcels. The answer is: maybe.

South Carolina Lien and Bond Claim Rights

Furnishing to a construction project in South Carolina? Let's review mechanic’s lien and bond claim rights for projects in South Carolina.

Join the NCS Credit Team

Various members of our team share why they love working at NCS Credit.

Arbitration is Alternative Dispute Resolution

Arbitration, like mediation and adjudication, is a form of alternative dispute resolution and is typically favored in lieu of litigation.

UCC Filings, Key Words and Common Terms

In the spirit of “back-to-school,” today’s post is a UCC Article 9 vocabulary lesson. Break out your pencils and notebooks, let’s get started!

Mechanic’s Lien and Bond Claim Rights in U.S. Possessions

Did you know that you may have mechanic's lien or bond claim rights in Guam, US Virgin Islands and Puerto Rico? Let’s review!

Alaska Mechanic’s Liens and Bond Claims

In this post I will review the statutory requirements for securing lien and bond claim rights for projects in Alaska.

Protect Lien Rights: Who is Served Iowa Preliminary Notice

Mechanic’s lien rights are available on commercial and residential projects in Iowa, however, you should always serve a preliminary notice.

Name Change Could Jeopardize Your Security Interest

The accuracy of critical data, like your customer's name, within your UCC Financing Statement can make or break your security interest.

Progress Payments Have Stopped, Now What?

Progress payments are made as work progresses under a contract, but what if those payments stop? What should you do next? Learn more here.

A Demand to Commence Suit May Shorten Your Deadline

Did you receive a Notice to Commence Suit? Review the document carefully, because your deadline to file suit may be sooner than you think.

Retail Bankruptcy and the Impact on the Landlord

We’ve previously discussed what retail bankruptcies mean for creditors who supply inventory, but what about the landlord?

DIP Financing: What Is It? Who Provides It?

DIP Financing (DIP = Debtor In Possession): What is It? Who provides It? What impact does it have on UCC filings?

Serve a Mechanic's Lien on an Out-of-State Party

Need to serve a mechanic's lien on an out-of-state party? According to one case, you should serve the lien via certified mail with return receipt requested.

Retail Bankruptcies and Their Impact on Consigned Goods

Often, retailers obtain goods from various suppliers. Suppliers provide the goods on a consignment basis. So, what happens when there's a bankruptcy?

Are Pre-Construction Management Services Lienable?

A Court has determined “pre-construction management services” are lienable, but the claimant better be prepared to provide a clear, itemized statement of account.

Serving a PA Mechanic's Lien: Sheriff or Public Posting

In Pennsylvania, a mechanic’s lien be served by a sheriff. If the sheriff is unable to serve the lien, you should post the lien at the site.

Mechanic’s Liens and Bond Claims are a Right

If you have furnished to a construction project, you have a right to be paid. Mechanic's liens and bond claims are your security.

Subcontractor Granted New Hampshire Mechanic's Lien

Learn more about a New Hampshire court’s decision to uphold the subcontractor’s mechanic’s lien for $4,917,122.02

Waiving Bond Claim Rights Under The Miller Act

If you furnish to a federal construction project, and your contract includes a provision for claim resolution outside of the Miller Act, are you prohibited from pursing a claim under the Miller Act?

Unsecured Creditors in Retail Bankruptcy Lose Out

As a creditor, it is important to ask yourself “In what ways can our company mitigate risk in today’s volatile credit environment?”

Pennsylvania Strengthens Payment Act (CASPA)

Early June, Pennsylvania enacted amendments to its Contractor and Subcontractor Payment Act (CASPA). Learn more about the amendments.

UCC Filing Collateral Descriptions and Interpreting “And All”

Learn about a Missouri court's ruling on creditor priority in collateral. Focus on the impact of security interests at multiple properties.

Residential Construction Projects & Liens in New Jersey

New Jersey is one of 17 states with mechanic’s lien statute specific to residential projects. Learn more about securing your rights.

Court Says It's a Ripe Claim Under the Miller Act

If you are pursuing an administrative claim, do you have to wait to pursue a Miller Act Bond Claim? The court says it's ripe to review!

Adjudication and Ontario’s Construction Lien Act

Amendments to Ontario’s Construction Lien Act go into effect in July 2018 and October 2019. In today’s post we are going to discuss adjudication.

Secretary of State Errors and Your Security Interest

What happens if you comply with Article 9 and take the proper steps to perfect your security interest, only to have the Secretary of State make an error?

Promises Won’t Bring Massachusetts Lien Back

In Massachusetts, a project owner promised to pay its subcontractor, so the subcontractor allowed its suit deadline to expire.

Value of Salvaged Materials Increased Contract Amount

Can the resale value of salvaged materials from a demolition site be included in the total contract amount and subsequently be lienable? According to one legal decision, yes.

New Regulations under Ontario’s Construction Lien Act

Ontario’s Construction Lien Act changes go into effect July 1, 2018. Ahead of these changes, Ontario’s legislature has released new regulations to help clarify the changes.

Convenience of Prevenient Arrangements and a Text Message

A prevenient arrangement occurs when parties enter “…into an ongoing relationship for the supply of services or materials over time, often at multiple locations.”

Security Interests in Liquor Licenses OK in Pennsylvania

Yes, creditors can take a secured interest in a debtor’s liquor license in Pennsylvania, according to one recent Bankruptcy Court decision.

Pass-Through Claims and The Severin Doctrine

In construction, a pass-through claim is when one party makes a claim on a second party’s behalf. What does it have to do with Severin Doctrine?

UCCs and Liens Make Your Company a Payment Priority

Businesses prioritize how, when and which vendors are paid and often pay secured creditors ahead of unsecured creditors. But why?

Substantial Completion, Completion and Acceptance

A supplier’s suit was untimely, because it failed to comply with filing suit within one year from substantial completion of the project.

Securing Mechanic’s Lien Rights in Wyoming

Here’s everything you didn’t know you should know about securing mechanic’s lien rights on projects in Wyoming.

Changes to Ontario's Construction Act

The review of Ontario’s Construction Lien Act (Act) began in February 2015 and in August 2016 the review committee presented its recommendations for improving the Act, which we've previously...

Lien Should Be Filed by Registered Entity

A construction lien can be invalidated if the lien claimant isn't registered with the Secretary of State or comparable agency.

Can a New York Mechanic's Lien Be Filed Too Early

The Court reviewed and found the lien was not served too soon & the claimant’s lien would remain valid. But, what’s “too soon” in New York?

Federally Funded Does Not Mean Federal Project

“The U.S. Government funded this construction project, so it’s a federal project, right?” The answer is: not necessarily.

How to Handle Suit When Mechanic’s Liens Expire

What happens after a mechanic's lien is filed? You should understand Suit to Enforce your claim, because mechanic's liens don't live forever.

New Legislation for Ontario's Construction Act

Broad changes ahead for Ontario’s Construction Act. A high-level look at some key changes including the extension of the lien & suit filing periods.

Top 3 Mistakes Collectors Make According to IACC

What are the top 3 mistakes made when calling on past due accounts? Poor documentation & communication are the top 2.

Register Operator’s Liens with a PPSA

Executing an Operator’s Lien? Make sure to register it with a PPSA. Learn how one creditor lost its priority for failing to comply with the PPSA.

Don’t Gamble with Your Lien Rights in Nevada

Mechanic’s lien rights are afforded to those furnishing to Nevada construction projects, if you adhere to the statutory requirements.

Massachusetts Mechanic’s Lien in a Bankruptcy

If a party files for bankruptcy in Massachusetts, ensure your mechanic’s lien filing is not in violation of the bankruptcy code.

Carefully Review Settlement Agreements

Settlement agreements are common. You must carefully review the agreement or you may end up with invalid liens, like this subcontractor.

Is “Final Payment” Written on the Check?

Checks are monetary agreements and should be treated with care. If you receive payment, and there are conditions or terms within the payment, seek legal guidance.

Filing a UCC to Perfect Your Security Interest

In a fight for priority, a creditor claimed it had valid security. Unfortunately, the creditor did not list the debtor’s name correctly on the UCC.

Bond Claim and Stop Notice Rights in California

Bookmark this post; here’s everything you should know about securing bond claim and stop notice rights on public projects in California!

Form for Registering Liens on Leasehold in Alberta

Registering a builders’ lien in Alberta? Correctly identify and notify all parties within the ladder of supply, and ensure the form is completed in its entirety.

Compliance with UCC Article 9-503 and Alternative "A"

Filing a UCC on an individual? It is critical that you comply with Article § 9-503(a): The Financing Statement must list the debtor’s name as it appears on the debtor’s unexpired driver’s license.

Secured Creditor Bumped to Unsecured Status

Strict compliance with Article 9 is imperative. Article 9-503(1) clearly states the debtor’s name must be identified as it appears on the public organic record.

Is Pay-if-Paid Enforceable in Kentucky?

Is pay-if-paid enforceable in Kentucky? According to one recent Supreme Court decision, yes. Learn more when you ready this post.

New York Lien Discharged by Bond

What happens if a payment bond is substituted for the mechanic's lien? According to one recent court opinion, lien deadlines still apply.

You Need a Preliminary Notice Program

You need a Preliminary Notice program, not a Mechanic's Lien program. Download this resource to learn more about how a Preliminary Notice program will improve your DSO, improve your cash flow &...

Free Forms Online - Proceed with Caution

Using an online form to secure your mechanic's lien rights? Be careful! And make sure the documents meet statutory format & content requirements.

Prompt Payment: Which Applies, State or Federal Statute?

In Arizona, prompt payment statute states a project owner should remit payment to the GC within 7 days after the approved billing cycle.

Residential Projects & Mechanic's Lien Rights

If you are furnishing to a residential project, review preliminary notice & mechanic’s lien requirements carefully.

EC: Importance of Preliminary Notices

In this NCS Extra Credit installment, Pete Pozzuto (Business Development Representative) discusses the importance of preliminary notices.

Heard about the NCS OnDemand Webinar Series?

In this NCS Extra Credit installment, Pete Pozzuto (Business Development Representative) discusses the NCS OnDemand webinar series.

UCC Filings and Defaults & Remedies

Our final section in this series covers Default & Remedies under Article 9. What is default? What remedies are available? Read on to learn more

Learn More about Bankruptcy Search & Monitoring

In this NCS Extra Credit installment, Pete Pozzuto (Business Development Representative) discusses Bankruptcy Search & Monitoring.

Substantial Compliance with Florida Lien Law

Would-be mechanic’s lien claimants shouldn’t mess with Florida! Florida statute is concise and there is little room for error.

UCCs & Priority of a Security Interest

Who has priority? Are there exceptions? Learn more in part 4 of our secured transaction series, where we review Priority under Article 9.

The Critical Role of Furnishing Dates in Lien Rights

A key to properly calculating mechanic’s lien and bond claim deadlines is knowing your first & last furnishing dates.

Who Owns the Improved Upon Property?

Filing a mechanic's lien? Take the time to confirm property ownership, and if applicable, serve the registered agent for the owner.

EC: All Inclusive Public Records Search

In this NCS Extra Credit installment, Pete Pozzuto (Business Development Representative) discusses the All Inclusive Public Records Search.

UCCs & Perfection of a Security Interest

What is perfection of a security interest? Learn more about perfection, the Financing Statement, and where to file the Financing Statement.

Serve Your Mechanic’s Lien in Accordance with Statute

Just as with notice requirements, lien statute varies by state, which means the required method(s) for service of the lien can vary.

Can Your Mechanic's Lien Rights Be Waived?

We are often asked whether a waiver of lien rights clause can be incorporated within a contract and whether it's enforceable.

Contractual Waiver of Lien Rights

Download this quick reference guide to learn more about waiver of lien rights within a contract by state.

Is a Contractor's License Required to File a Lien?

As if mechanic’s lien laws aren't complicated enough, you must also understand and adhere to the licensing requirements for each state.

Conveying Security Interest via UCCs

Conveying a security interest under Article 9? Learn more about attachment, the security agreement, and the rights & duties of the secured party.

When Space & Noise Impact UCC Filings

Clients frequently ask us, “Does an extra space or added punctuation in my customer’s registered name really matter?” For UCCs, it might!

Owners Can Bond Off Liens & Contest Frivolous Liens

An exaggerated lien could be deemed a frivolous lien. Here's a reminder that a lien claimant needs to have documentation to support its claim.

How to Avoid Invalidating Your Mechanics Lien

If you take the time to file a mechanic’s lien, don’t squander your security. Make sure you follow through with subsequent legal requests.

Despite Disputes, Release Retainage

Retainage is an agreed amount of a contract price that is retained by one party from another, with an assurance that the party will be paid once the job is completed.

Hitachi High Technologies: Corporate Monitoring Benefits

It's your responsibility to ensure the UCC filling is up to date and contains the correct information. How will you know if a customer’s status or name changes? Find out how.

Payment Bonds Can Be Conditional Too

Are you furnishing to a private Florida project where a payment bond has been issued? Then you should take a few minutes to read this.

UCC Introduction and Scope of Article 9

Article 9 includes consensual security interests in personal property and fixtures. Learn more about what's included, what's excluded, and collateral.

What is a Notice of Intent to Lien?

A Notice of Intent is a statutory notice, required in many states, to be served prior to filing a mechanic’s lien.

We Are NCS Credit

Learn about NCS Credit with this journey through time: The Birth of NCS Credit | 1985: A Landmark Year | The Cowan Family | NCS on the Move | People, Process, Performance | Evolving Technology |...

The Miller Act & Your Bond Rights in Tribal Construction

Explore the nuances of bond claim rights in tribal construction projects without Miller Act protections. Safeguard your interests today.

Correctly Identify Your Customer on PPSAs in Ontario

Registering a PPSA in Ontario? Then you know the importance of correctly identifying your customer. According to the PPSA, you should identify your debtor by its English and French names.

Timely Amend Your Proof of Claim

We’ve discussed bankruptcy proof of claims before, but today we are reminded just how vital accuracy is when filing a proof of claim.

3-in-3: Payment & Performance Bonds

A payment bond is a valuable risk-reducing tool for creditors furnishing materials and/or services to construction projects.

Can a Mechanic's Lien Be Avoided in Bankruptcy

If you have concerns about a project you are furnishing to, or a party within the contractual chain filing bankruptcy, you may want to take an extra step and confirm statutory guidelines for the date...

Four Signs Your Customer May Be in Financial Distress

Don’t expose your AR to any unnecessary risk. Business failure is inevitable. Your best defense? Be proactive. Take advantage of secured transactions and pay attention to signs of distress.

3-in-3: Taking a Secured Interest in Canada via the PPSA