Blanket UCC Filings & Your Frequently Asked Questions

What is a Blanket UCC Filing?

A Blanket UCC filing is a security interest in all the assets of your customer on a non-priority basis, eliminating potential conflict with your customer’s primary lender. The priority or payout in a bankruptcy is determined by the filing date (first in time, first in right). The UCC filing elevates the status of your accounts receivable to that of a secured creditor.

Blanket filings are applicable when providing financing, selling services, or in situations when your customer “consumes” or otherwise does not stock your goods.

Why Choose a Blanket Filing?

Let’s hear from expert, Cindy Bordelon, NCS’ UCC Services Manager!

“When determining the type of UCC to be filed, you first must define your goal. Do you want to take a priority interest in your goods and be able to repossess? Or, would you rather take a security interest in all of the customer

’s assets? If your goal is “all assets,” clearly identify the collateral and have your customer grant that interest by executing a Security Agreement. With the Security Agreement signed, you can proceed with your blanket filing, knowing your position is the day and time the UCC filing is recorded. As a best practice, I recommend always conducting a UCC search before filing. This search will tell you who may be ahead of you and what your potential position may be, helping you to make a good credit decision.”

Is there a Filing Deadline?

Much like other credit remedies, there are “deadlines” for filing a timely Financing Statement. If you are filing a Blanket UCC, the filing should be recorded prior to lending or shipping.

What if My Customer Defaults or Files for Bankruptcy Protection?

If your customer has defaulted on payment(s) and you have filed a Blanket UCC, you could place the outstanding debt with a collection agency or file suit against your debtor.

- If your customer filed Chapter 7, file a secured proof of claim.

- If your customer filed Chapter 11, file a secured proof of claim and monitor for distribution.

What If My Customer Sells Its Business?

Companies sell businesses all the time. The primary reason a company sells its business is because it is in fiscal distress, and selling the business is a means of escaping the debt. If they can escape the debt, how can a UCC possibly help? Your UCC filing acts as a lien on the business; therefore, before title passes from one party to another, the lien should be acknowledged and either settled or renegotiated.

Who Wants to Hear a Story?

Here’s a story of a new restaurateur, whose creditors secured via Blanket Filings, and the fate of the restaurateur’s secured & unsecured creditors in a Chapter 7 bankruptcy.

Chef Charles is going to start a restaurant. He’s worked in the restaurant industry his entire working life and thinks “OK, I’m pretty good at this. I know how to run a restaurant, and how to make foods that are delicious and attractive, plus I can create an environment where people will want to dine.”

Chef Charles creates his business plan and determines he needs start-up capital, so he goes to the bank with his business plan and a request for $20,000. The bank reviews his plan and decides to lend the $20,000 to Chef Charles, and the bank perfects their security interest.

Chef Charles is ready to start. Various vendors will solicit Chef Charles regarding different materials and services he may need, and each vendor that successfully sells their goods to Chef Charles will need to decide whether they are going to sell on open credit terms, via credit card or cash in advance. If the vendor decides to sell on open terms, the vendor will need to further decide whether they will sell on a secured or unsecured basis.

Chef Charles has selected his vendors. Of his numerous vendors, four of them have taken a security interest and filed a UCC.

Secured Creditor 1: $10,000

Secured Creditor 2: $10,000

Secured Creditor 3: $5,000

Secured Creditor 4: $10,000

We’ll assume the remaining vendors have opted to sell on unsecured open terms.

Business is underway! At any given time, Chef Charles has $61,000 in assets.

Unfortunately, 3 years later Chef Charles becomes a statistic, when his business fails, and he files for Chapter 7 bankruptcy protection.

What happens to his creditors? It’s simple, Chef Charles’s assets will be liquidated and creditors will be paid by priority. Creditor priority is based on first in time, first in right.

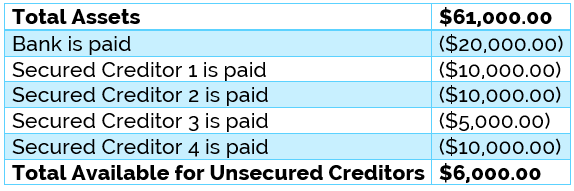

The bankruptcy trustee is going to liquidate Chef Charles’s $61,000 in assets and begin paying his creditors.

The bank was the first party to lend and take a secured interest, so they will be the first paid, then the other vendors who filed UCCs will be paid in the order in which they secured their interest.

Once the secured creditors have been paid, there is $6,000 remaining, and that $6,000 will be disbursed on a pro-rata basis to all general unsecured creditors.

In this case, Chef Charles has 100 unsecured creditors that were each owed $1,000. Each of these creditors will receive $60 (based on the pro-rata disbursement) or 6 cents on the dollar

More questions on Blanket Filings, contact us!