The Review of Ontario’s Construction Lien Act: Surety Bonds

We’ve previously discussed the review of Ontario’s Construction Lien Act and today we’d like to briefly review the recommendations for how surety bonds could be handled under the Act.

Generally, there is no statutory provision requiring a payment bond be issued for a public project.

“Currently, statutory mandatory bond regimes for public projects only exist in the U.S. but the use of payment bonds for the protection of subcontractors and suppliers is common in Canada. Fundamentally, payment bonds are currently a North American phenomenon. However, mandatory payment bonds have been considered in some other jurisdictions.” – Chapter 10: Surety Bonds, 2.2 Mandatory Surety Bonds

Although not required, frequently public projects are bonded, which provides those furnishing to public projects the ability to secure rights in the event they are not paid. But what happens to those who furnish to a project that isn’t bonded? How can they secure their right to get paid?

Right of Recourse: Public Projects in Ontario

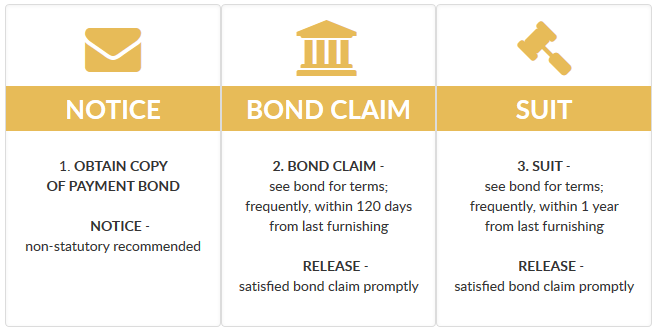

As mentioned above, if a public project is bonded, then claimants have an opportunity to make a claim against the bond. You should review the terms of the bond to determine the deadline for claims, but frequently the deadline is within 120 days from last furnishing materials or services.

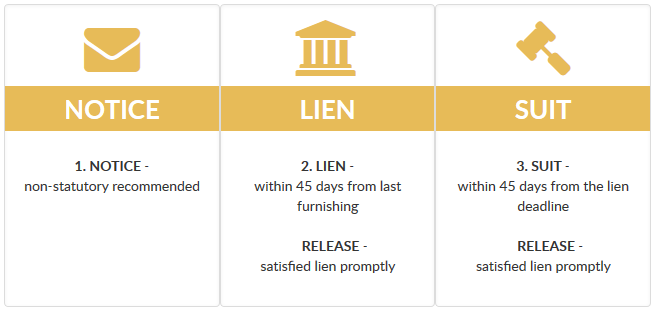

Claimants may also have the right to a Public Improvement Lien (aka lien on funds).

What Changes Would the Review Group Like to See

The committee reviewing the Act partnered with the Surety Association of Canada and came up with the greatest recommendation: a requirement for bonds on all public projects!

- The Act should be amended to require broad form surety bonds to be issued for all public sector projects, the form of such surety bonds should be developed in consultation with the Surety Association of Canada, and once finalized they should become Forms under the Act.

- The Act should be amended to require sureties to pay all undisputed amounts within a reasonable time from the receipt of a payment bond claim.

- A Regulation to the Act should be promulgated to embody a surety claims handling protocol, and that such surety claims handling protocol be developed in consultation with the Surety Association of Canada.

As noted earlier, payment bonds are not required by statute right now. In the event a party is not paid and isn’t able to file a lien on funds, the only recourse available is to go after parties individually. A requirement for payment bonds would be great news for those furnishing to public projects.

Hopeful!

Again, a required payment bond is a recommendation from the committee reviewing the Act, it’s not actual legislation…yet. Stay tuned!