Hip Hop & Credit Management: Advice to Credit Professionals in 30 Seconds

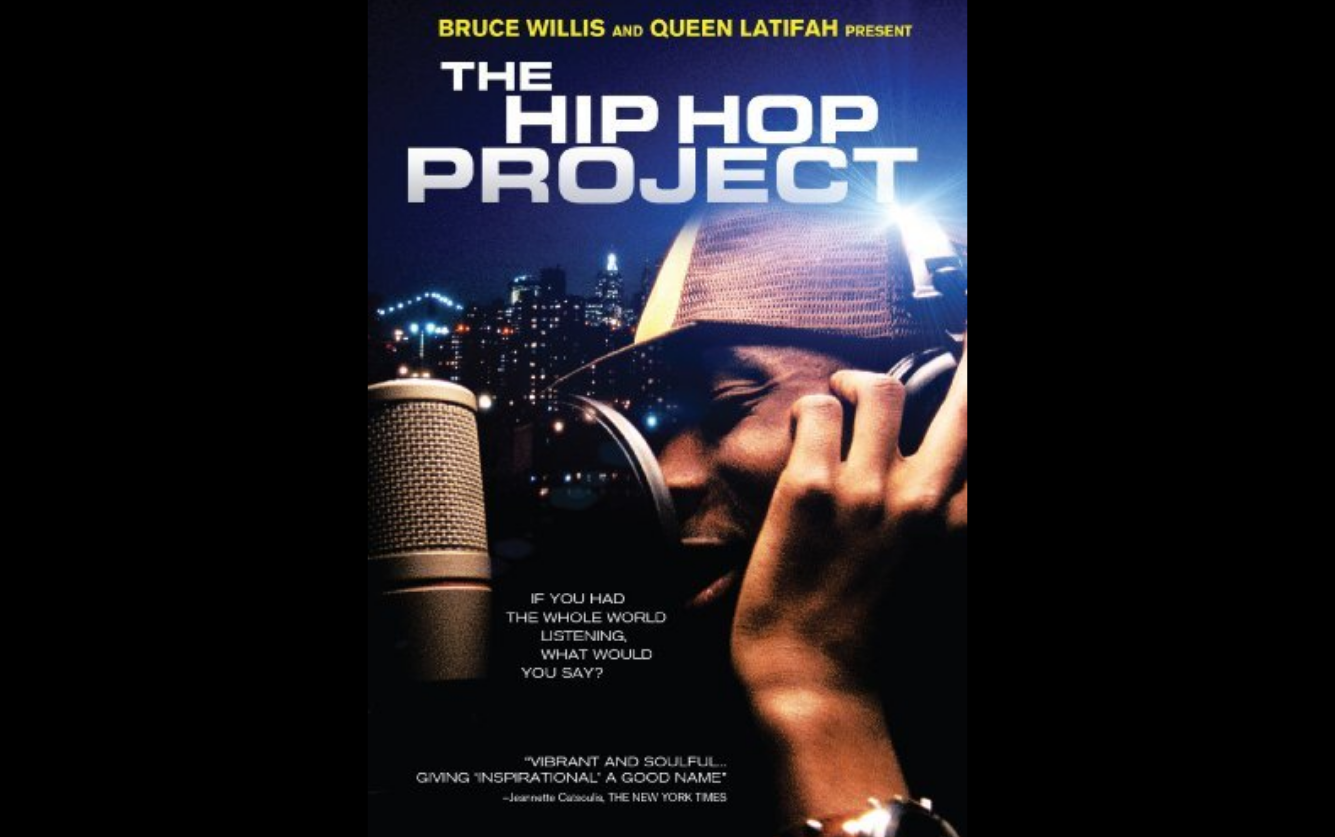

Several years ago, I was given the opportunity to view a documentary, hosted by its creator, The Hip Hop Project. The documentary centers on a formerly homeless teenager who wants to inspire and empower youth. There were many poignant and salient moments, but one question resonated throughout the film “If you had the whole world listening, what would you have to say?”

“That’s great Kristin – touching story, really – but what on earth does this have to do with credit management?!” I’m so glad you asked!

A friend of mine recently took a position in the credit department at a large manufacturer and she asked me:

“See, my boss wants me to come up with a plan on how they can improve the margins without taking too much risk. But they already have a process and I’m not really sure that there is anything else I can bring to the table. Got any advice?”

I sat across from her, silently – any time I’m problem solving, I tend to ask myself “If I had 30 seconds to convey my thoughts to a silent & listening world, what would I say?” (I have to impose a time limit on myself, otherwise I’d never snap back to reality.) She interrupted my 30 seconds to tell me that most of their customers have been customers forever, though if they have a new customer they pull a credit report, sometimes they ask for a letter of credit, sometimes they require payment up front and other times they simply invoice and hope the invoice is paid within the allotted 45 days.

My friend interrupted my 30 seconds, but between her question and the documentary question, I decided to ask a few of my NCS colleagues

“If you had 30 seconds to give a credit professional advice on reducing risk, what would you say?”

Here’s what they had to say – I hope you can take a few minutes to “listen.”

Know Your Customer

“Know your customer! Knowing their history before contracting with your customer, means you have the opportunity to mitigate loss. You have the opportunity to save valuable time and money; be proactive not reactive. Take advantage of project and party monitoring services. With services like LienFinder, Corporate Monitoring and credit reporting, you can set email alerts to advise you of any project or party activity. Wouldn’t you want to know of changes as soon as possible? I would think so!” – Mary Cowan, NCS President

Be Proactive

“If you would like to reduce your risk, secure your receivables. Being proactive in this regard can help to prevent major losses. Serve preliminary notices on all projects over a certain dollar limit so that if there are payment problems by anyone within the contractual chain, or if anyone files bankruptcy, you will have the right to make a claim against a payment bond or to file a mechanic’s lien. Preliminary notices, liens and bond claims provide great leverage when seeking payment. Follow the statutory requirements, and carefully track your deadlines to ensure that your rights are maintained. And, if payment is not forthcoming, take action (filing a lien or a bond claim) sooner rather than later. Often, collectability is dependent on the funds being held by the owner, or someone else within the contractual chain, so the best practice is to secure your rights as soon as possible.” – Nancy Kennerly, Executive Director

Secure More, Sell More

“Reducing risk needs to be balanced with the impact to sales and cost. Secured transactions are an economical way to extend trade credit while at the same time improving your standing to that of a secured creditor. The benefits are numerous with the greatest benefit being an improvement to cash flow. They also will provide you the ability to say “yes” to a marginal account that perhaps would not have received credit or as much credit in the past. The sales team should welcome this new tool to help them sell more” – Jerry Bailey, Executive Education & Sales Manager

Security Creates Leverage

“USE PROTECTION! Seriously, it is important that creditors are proactive in protecting themselves. How do they protect themselves? Ask the right questions— know your debtor, who they are, their credit history and financial stability and what it means to YOU. Check this information frequently! Things change fast. Get yourself secured & create leverage. Take the time to know what you need to do—or partner with a credit professional who does. Missing a notice or incorrectly identifying a contractual chain member can make the difference between secured and unsecured. Know if UCC’s, liens/bonds, personal guarantees, promissory notes, joint check agreements are available and applicable—the more leverage, the better! The more entities on the hook to pay you, the better! Documents! Signed contracts and/or purchase orders are a must! Don’t get sloppy or lazy or blame it on your “Sales Reps”. Take the time to get the proper paperwork in order NOW. You never know when you will need it. And then, it will be too late! And you will lose.” – Amy Poje-Marsh, Director of Operations

Are you noticing a trend? Be proactive, know your customer, secure your receivables.

So, if you had 30 seconds to give a credit professional advice on reducing risk, what would you say?

Oh, one other thing… I couldn’t help but recognize a similarity with The Hip Hop Project’s philosophy “…we empower them [youth] with the knowledge, tools and opportunity…” and the NCS philosophy “…empowers credit professionals by providing exceptional education, resources and innovative services…”